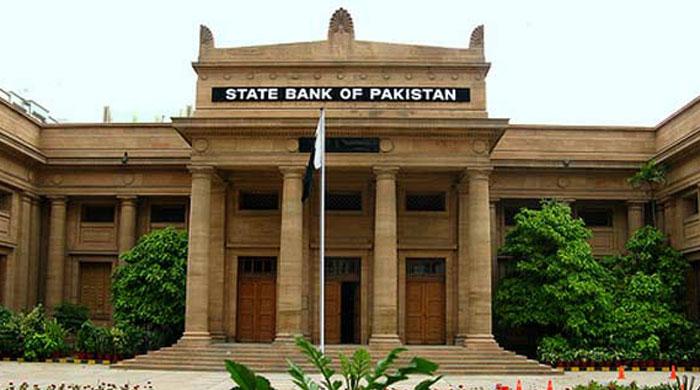

SBP governor says 'no risk in sight'

March 15, 2016

KARACHI: The governor of the State Bank of Pakistan has said the economy is stable and growing at the rate of four percent with stability in macroeconomic indicators posing no major risk in sight.

Pakistan's economy has shown marked recovery during the last two fiscal years, growing by over four percent. "This momentum has been maintained in the current year as well," Ashraf Mahmood Wathra said during a speech at the Pakistan Stock Exchange on Monday.

Earlier, in the preceding five-year period, the economy grew at an "anaemic” rate of 2.8 on average, he said.

Macroeconomic stability has been the key feature of this recovery: budget deficits are being contained without compromising on indispensable public spending; adequate level of foreign exchange buffer has crossed $20 billion for the first time; inflation and inflationary expectations are less likely to resurge anytime soon; and worker remittances are financing a large chunk of the trade and primary income deficits.

"What this tells us is that no major risks are in sight, which would undermine efforts in meeting our shared objective of achieving high growth; generating more jobs; and move further ahead on the development frontier," he said.

Wathra said this is the right time to accelerate domestic investment in the country to take it to the next level of robust high growth. "In the context of historically low interest rates, marked improvement in security conditions and energy supplies, and launch of CPEC-related initiatives, this is an opportune time to invest in new projects," he said.

Citing a recent analysis of non-financial companies listed at the stock exchange, the governor revealed the overall corporate sector is fairly liquid and possesses a healthy surplus of investable funds.

He termed the maturing of capital markets as a welcome sign for the private sector.

"With the advent of unified PSX, there is now a deep liquidity pool and a national platform for both domestic savers and investors to take advantage. For their part, corporate entities can benefit from enhanced access to savings, which can be channelled into new projects and developmental activities. In addition, the integration facilitates regulators in monitoring market activity, and allows a greater degree of efficiency and transparency," he said.

Chief Economic Adviser of SBP, Dr Saeed Ahmed said, "It is now time to move from stabilisation to growth and it is time for the private sector to lead economic recovery."

Non-financial corporate sector data reveals gradual deleveraging since the year 2009, and marked improvement in liquidity condition.

“The most conservative estimate of net surplus with the corporate sector is Rs446 billion [calculated as Current assets net of Current liabilities, without additional borrowing]. It is noted that some entities have parked their liquidity in Treasury Bills and Pakistan Investment Bonds. This is disturbing as the corporate sector is looking to benefit from investing in risk free government securities, instead of investing in real economic activities,” Dr Ahmed said.

The total investable resource, defined as twice the size of equity (based on assumption of debt-equity ratio of two) with short term investments, cash and near cash and excluding the total liabilities, turns out to be over Rs2.6 trillion. More than half of this potential lies in the energy sector alone. Some other major sectors include cement, textiles and autos, he said.

According to another definition of computing potential investable resources, which replaces total liabilities with total borrowings, the potential reaches over Rs3.7 trillion while the major sectors remain the same, he added.

Munir Kamal, Chairman, Pakistan Stock Exchange, said, "This is the first time in the history of the stock exchange in the country that the governor of State Bank has been invited to the gong ceremony of the stock exchange."

He said the tenth successful review of the economy by the International Monetary Fund under the Extended Fund Facility was an example of the upward trend in the economy.—Originally published in The News