Amazon, Berkshire, JPMorgan partner to cut US healthcare costs

January 31, 2018

Amazon.com Inc, Berkshire Hathaway, and JPMorgan Chase & Co said Tuesday they will form a company to cut health costs for hundreds of thousands of their US employees, setting up a major challenge to an inefficient US healthcare system.

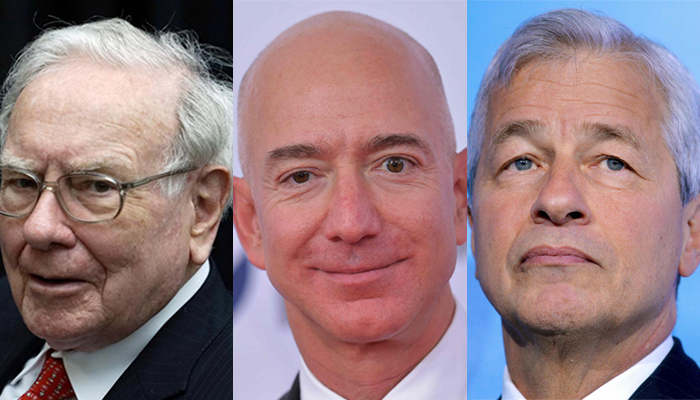

The move by three of the best-known US business leaders — Amazon’s Jeff Bezos, Berkshire’s Warren Buffett, and JPMorgan’s Jamie Dimon — would take on the world’s most expensive healthcare system, whose mounting costs have hurt corporate profits.

Shares in US healthcare companies fell across the board.

The new, not-for-profit venture will initially focus on technology for “simplified, high-quality, and transparent healthcare” for their more than 500,000 US employees. They did not elaborate on their strategy but said they are searching for a chief executive officer.

Healthcare industry experts say the new entity could eventually negotiate directly with drugmakers, doctors, and hospitals and use their vast databases to get a better handle on the costs of those services.

That could undercut the industry’s “middlemen,” from health insurers to pharmacies and benefits managers.

“The ballooning costs of healthcare act as a hungry tapeworm on the American economy,” said Berkshire Hathaway Chairman and Chief Executive Officer Warren Buffett.

“Our group does not come to this problem with answers. But we also do not accept it as inevitable.”

ISI Evercore analyst Michael Newshal said the selloff in healthcare stocks reflected the fear of disruption in a sector helped by rising prices year after year but is under growing scrutiny from US consumers, regulators, and politicians.

“There are a lot of companies, or arguably almost all companies, in healthcare that benefit from cost inflation running as high as it has been for many years.

"And, if there is pressure to lower that, that can flow throughout the entire system,” Newshal said.

Major disruptor?

US healthcare spending has been increasing annually faster than inflation, and, in 2017, accounted for 18 percent of the US economy. Corporations sponsor health benefits for more than 160 million Americans.

Major healthcare players have tried to reduce costs without losing their profit margins. Most recently, pharmacy network CVS Health Corp reached a $69-billion deal to buy insurer Aetna Inc, arguing their combination could save money for the nation’s employers.

Investors in the sector see Amazon becoming a major disruptor of healthcare, just as it has done in the retail industry, fueled by media reports in recent months that the company was considering entering the pharmacy business.

Teaming up with the biggest US bank JPMorgan and Berkshire — the third largest public company in the world — offers new opportunities to shake up the industry, analysts said.

For example, JPMorgan could help shape new payment models for consumers and providers and provide cost data. CEO Dimon has for years expressed concerns about rising healthcare costs.

In 2015, he wrote in his annual letter that the company spent $1.1 billion on medical benefits for US employees, 2 percent of companywide expenses.

Berkshire CEO Buffett has long complained that high health care costs were hurting American businesses and publicly began using the term “tapeworm” to describe their effects as early as 2010.

The partnership will be spearheaded by Berkshire investment officer Todd Combs, JPMorgan managing director Marvelle Berchtold, and Amazon senior vice president Beth Galetti.

Combs, 47, has been an investment deputy to Buffett since 2010 and joined JPMorgan’s board in 2016.

Insurers fall

Health insurers that provide benefit management or health plans to Amazon, JPMorgan, and Berkshire could be among the hardest hit.

JPMorgan uses UnitedHealth Group Inc and Cigna Corp for health benefits for its global workforce, according to ISI Evercore analyst Ross Muken. Neither company was available for comment.

Amazon uses Premera Blue Cross, part of the Blue Cross Blue Shield network, according to Muken. Express Scripts — the pharmacy benefits manager — has disclosed it manages pharmacy benefits for Amazon.

Shares in UnitedHealth, Cigna Corp, and health insurer Anthem Inc fell 3 percent to 7 percent.

Drugstore operators CVS and Walgreen Boots Alliance as well as Express Scripts all dropped between 4 percent to 5 percent.

Drug distributors Cardinal Health, AmerisourceBergen, and McKesson were off 1 percent to 3 percent.

Amazon added 0.7 percent.