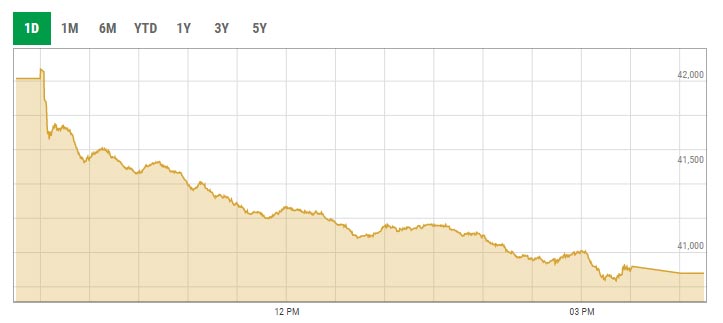

Bloodbath at PSX as benchmark index plunges over 1,100 points

KSE-100 falls below 41,000 level with economic uncertainty, lack of positive triggers doing enough to push stocks deep in red

June 13, 2022

- KSE-100 falls below 41,000 level after a decline of over 2%.

- PSX closes trading at 40,879.93 points.

- Volumes increased from 115.9m shares to 163.8m shares.

KARACHI: Investors at the Pakistan Stock Exchange (PSX) adopted a dump-and-run approach as the benchmark KSE-100 index plunged over 1,100 points or 2.7%, falling below the 41,000 level with economic uncertainty and lack of positive triggers doing enough to push stocks deep in the red.

The KSE-100 — a benchmark for market performance — underwent selling pressure from the word go, dipping to a low of 40,834.97 with volumes remaining stable.

Market talk suggested that the delay in the revival of the International Monetary Fund (IMF) programme despite constant efforts is the chief reason behind investors’ dump-and-run approach at the PSX.

Read more: IMF unhappy over non-implementation of its income tax proposals, says Miftah Ismail

The index has been under immense pressure since the last week when Finance Minister Miftah Ismail announced the federal budget that was widely seen as a negative for the revival of the stalled $6 billion IMF programme.

An overbought market was then given a rude awakening when the Pakistani rupee broke all records and closed at an all-time low of Rs203.86 against the US dollar.

It is also worth mentioning that last week, the PSX became the third-worst performing market in Asia, despite having won the title of Asia’s best-performing stock market in August 2020.

At close, the benchmark KSE-100 index closed at 40,879.93 points with a loss of 1,134.80 points or 2.70%.

A report from Arif Habib Limited in its post-market commentary noted that the PSX witnessed a bloodbath session today due to high inflationary and post-budget concerns.

Read more: Pakistan optimistic about position on FATF grey list

“The benchmark KSE-100 index plunged by over 1,179 points as investors were unable to digest the adverse measures announced in the budget,” the report stated.

Moreover, the brokerage house stated that the rupee continued to decline against the US dollar. The banking sector stayed in the red zone due to harsh taxation imposed on the budget. Institutional investors remained on the sell-side due to redemptions arising from the mutual funds.

Sectors contributing to the performance included banks (-481.9 points), exploration and production (-134.9 points), cement (-97.5 points), technology (-96.6 points) and fertiliser (-74.9 points).

Read more: Financial markets take a hit as budget fails to restore investors’ confidence

Shares of 331 companies were traded during the session. At the close of trading, 50 scrips closed in the green, 263 in the red, and 18 remained unchanged.

Overall trading volumes rose to 163.79 million shares compared with Friday’s tally of 115.87 million. The value of shares traded during the day was Rs4.35 billion.

Hum Network was the volume leader with 24.56 million shares traded, gaining Rs0.04 to close at Rs7.08. It was followed by Cnergyico PK Limited with 6.89 million shares traded, losing Rs0.15 to close at Rs5.11 and K-Electric with 6.52 million shares traded, losing Rs0.07 to close at Rs2.55.