Rupee extends gains as currency market focuses on positive cues

Local currency settles at Rs171.29 against the US dollar in the inter-bank market

November 01, 2021

- Local currency settles at Rs171.29 against the US dollar in the inter-bank market.

- Analysts believe trends suggest the rupee is likely to strengthen further in the ongoing week.

- The rupee on a real effective exchange rate basis is currently undervalued.

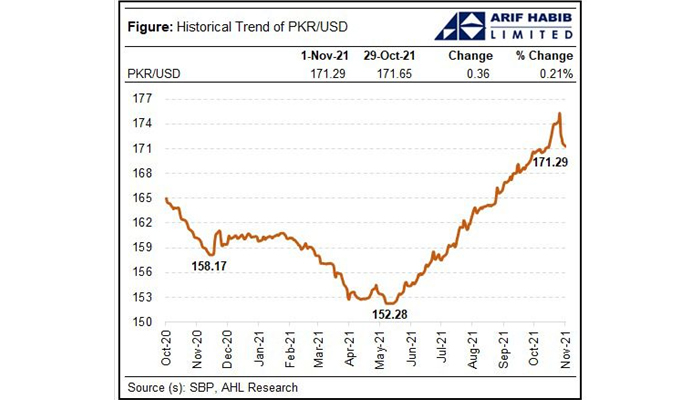

KARACHI: The US dollar lost 36 paisas against the rupee on Monday in the inter-bank market, with currency experts believing that the downward trend would continue on the back of improved supply of hard currency and positive investor sentiments.

With a fresh increase of 0.21%, the Pakistani rupee settled at Rs171.29 against the US dollar in the inter-bank market on Monday.

The rupee saw a recovery on the back of clarity on the International Monetary Fund (IMF) programme. The currency has gained around Rs3.98 against the greenback during the last four sessions.

Analysts believe the trends suggest that the rupee is likely to strengthen further over the ongoing week in view of improved inflows as the revival of the IMF Extended Fund Facility could boost sentiments and compel exporters to go for the forward sale of dollars.

“Importers are also expected to slow down their payments,” they said.

Earlier, the local currency had been under pressure because of a surging current account deficit amid a spike in imports. The depreciation of the rupee stoked inflationary pressures and the government had raised electricity and fuel prices.

Analysts said an IMF deal, along with confirmation that a $2.7 billion COVID-19 support fund can be used for budgetary support measures, is expected to lift the rupee higher.

The rupee on a Real Effective Exchange Rate (REER) basis is currently undervalued. The REER index fell to 95.9 in September, depreciating by 0.7% compared with last month. The REER has depreciated by 4% since the beginning of the fiscal year 2021-22. The declining trend in the REER is an indication of a strong rupee.