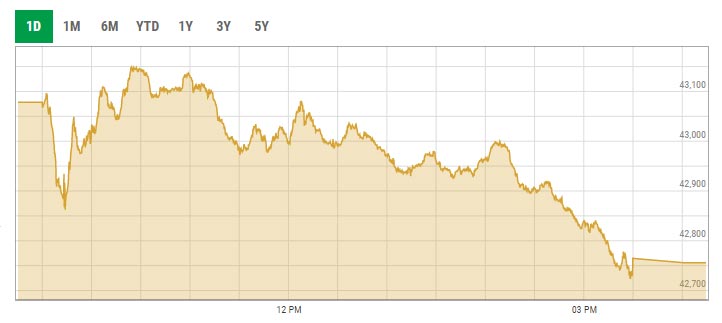

Inflation concerns push KSE-100 index below 43,000-mark

June 01, 2022

- All index-heavy sectors lost ground, closing with marginal losses.

- At close, KSE-100 index declined 0.75% to settle at 42,756.04 points.

- Shares of 334 companies were traded during the session.

KARACHI: The bears staged a comeback at the Pakistan Stock Exchange (PSX) market on Wednesday as the benchmark KSE-100 index experienced another round of battering and shed over 300 points.

Inflation concerns arising from the reversal of subsidies shattered investor confidence. Widespread uncertainty about political developments exacerbated the market’s decline.

All index-heavy sectors lost major ground and closed with marginal losses.

Earlier, trading began on a negative note and the market remained on the downtrend till the end of the session.

At close, the benchmark KSE-100 index recorded a decrease of 322.10 points, or 0.75%, to settle at 42,756.04 points.

A report from Arif Habib Limited noted that the market remained under pressure as investors remained stagnant over expectations of an adverse budget announcement.

“The benchmark KSE-100 index plunged to 354 points as selling pressure was witnessed across the board due to concerns over increasing inflation which kept the investors at bay,” the brokerage house stated.

Mainboard activities remained dull on the contrary hefty volumes were observed in the third-tier stocks.

Sectors contributing to the performance included power (-67.8 points), banks (-65.7 points), cement (-55.2 points), technology (-41.1 points) and exploration and production (-32.4 points).

Shares of 334 companies were traded during the session. At the close of trading, 98 scrips closed in the green, 207 in the red, and 29 remained unchanged.

Overall trading volumes rose to 194.39 million shares compared with Tuesday's tally of 285.34 million. The value of shares traded during the day was Rs5.34 billion.

Silk Bank was the volume leader with 24.62 million shares traded, losing Rs0.01 to close at Rs1.49. It was followed by Unity Foods with 14.09 million shares traded, losing Rs0.47 to close at Rs22.30 and Ghani Global Holdings with 13.49 million shares traded, losing Rs0.27 to close at Rs16.90.