Pakistani bonds receive 'B3 stable' rating from Moody's

'In recent years, credit has been supported by improved track record of reforms started under IMF program, and a stronger outlook for infrastructure investment driven by CPEC'

December 07, 2017

Moody's Investors Service has assigned a rating of B3 to the Government of Pakistan's (B3 stable) US dollar-denominated notes, a press release from the rating agency stated.

Pakistan's B3 issuer rating reflects a credit profile that balances robust growth potential and a relatively large economy, against low income levels, infrastructure constraints and very low global competitiveness, said Moody’s.

“In recent years, the credit has been supported by an improved track record of reforms started under an International Monetary Fund (IMF) program, and a stronger outlook for infrastructure investment driven by the China-Pakistan Economic Corridor (CPEC) project,” the agency explained its rationale behind the rating.

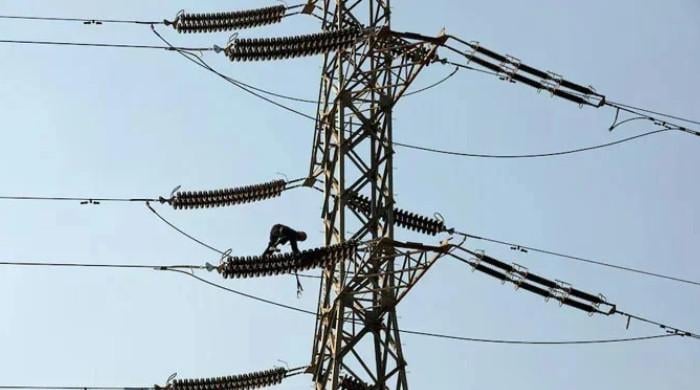

“Pakistan's economy demonstrates relatively robust GDP growth, limited by supply-side constraints on the economy…. Moving forward, implementation of the CPEC will, over time, partly address supply-side constraints through investment in power generation and transport infrastructure, thereby bolstering Pakistan's growth potential and competitiveness,” it said.

However, security related issues and a weak track record of public project implementation suggest the pace of project execution will be relatively slow, the release added.

Moody’s said Pakistan's institutional strength is improving from a very low base, a reflection of significant traction on reforms under and following Pakistan's recent IMF program, which concluded in September 2016, along with improvements in transparency.

“Key IMF program goals included fiscal deficit reduction, strengthening of the monetary policy framework, resolving constraints in the energy sector, and state-owned enterprise reform. Continued government commitment to implementation of reforms would help reinforce fiscal and monetary policy discipline, thereby preserving recent macroeconomic stability gains and strengthening institutional effectiveness in the future. Such improvements would help support the sovereign credit profile through enhanced policy credibility and effectiveness,” the agency said in its release.

Moody’s noted that the stable outlook on the issuer rating reflects a balance of positive and negative pressures.

“On the upside, there is potential for further strengthening in growth beyond our current expectations, as successful implementation of the CPEC project may transform the Pakistani economy by removing infrastructure bottlenecks and stimulating both foreign and domestic investment.

“On the downside, the economic benefits of CPEC are still highly uncertain and power supply may continue to constrain growth to a greater extent than we currently envisage. Moreover, the fiscal costs related to the project and, more generally, development spending could raise Pakistan's debt burden more rapidly and significantly than we expect. In addition, recent indications of renewed increases in external pressure could develop into greater external vulnerability,” Moody’s stated.