FBR reopens investigation into sales tax refund scam: report

Three companies allegedly involved in embezzling billions of rupees through fake trade invoices, say officials

January 22, 2020

KARACHI: Taxation authorities on Tuesday reopened investigations into an eight-year old tax refund scam against three companies suspected of embezzling billions of rupees through fake trade invoices, according to a report published in The News.

Tax officials told the publication that the bank accounts of the three companies had been frozen as part of the inquiry. The regional tax office in Karachi initiated the proceedings against Oriental Chemical Industries, Premier Industries and Yonus Enterprises, the report said.

The three companies are accused of "channeling sales tax refunds on fake/flying invoices to the tune of about Rs230 million during tax year 2011/2012," according to the charge-sheet against the companies available with the publication.

Also read: FBR instructs bakers, sweet marts to integrate sales: report

The names of the owners of the three firms have been put on the Exit Control List (ECL) as well. An official at the tax department said that the revenue authority has also approached property registrar officers to get more information about the assets owned by the suspected owners.

“Letters to all banks have also been written for getting information about the beneficiary bank accounts, whereby cheques issued as result of the generated ROPs were deposited," the officials told The News.

FBR officials say the cases could lead to a breakthrough in the mega sales tax refund scam in which the national exchequer was deprived of around Rs40 billion, besides income tax and federal excise duty, over the past few years by the suspected firms and their owners.

Also read: New tax law allows FBR to share asset declarations with FMU: report

It is pertinent to mention that thousands of fake companies registered with the regional tax office of the revenue authority had been obtaining sales tax refunds worth Rs40 billion through the use of fake invoices in the years 2010, 2011, and 2012.

At the time, tax officials had estimated that the national exchequer was deprived of about Rs88 billion in the said scam through income tax evasion as well. In July 2013, the FBR launched a crackdown against the bogus companies and blacklisted over 4,000 firms in this regard.

However, since then, legal proceedings against the culprits were either stopped or slowed down. Early in 2014, some senior officers of the regional tax office sent a report bypassing the FBR headquarters to the finance minister, FBR chairman and other authorities, mentioning the involvement of tax officials in the scam.

Also read: Government adds additional clause on immovable properties in NAB ordinance

According to the report, three regional tax offices blacklisted the sales tax registration of about 4,000 registered persons who were involved in tax fraud under section 21 (3) of the Sales Tax Act 1990.

“But no such coercive or corrective measures were ever taken by the offices to recover the evaded amount of Rs40 billion sales tax, (and) forge/bogus sales tax refund awarded with the collaboration of some senior tax officials,” according to an official document.

The document also noted that delinquent intention of the Inland Revenue Officers was apparently cleared as no such income tax assessment or re-assessment order was ever passed against such bogus or so called purchases made from blacklisted suppliers/transactions.

Also read: FBR's intelligence wing claims big win in campaign against bootlegged liquor

“Although, the Inland Revenue Officers blacklisted the sales tax registrations of the culprits/fraudsters, but neither recovery action nor re-assessment order of income tax was ever passed by them," it observed.

Sources said the FBR remained deliberately silent during the period despite an inquiry revealing that sales tax statements were filed from the tax offices on behalf of the dummy companies.

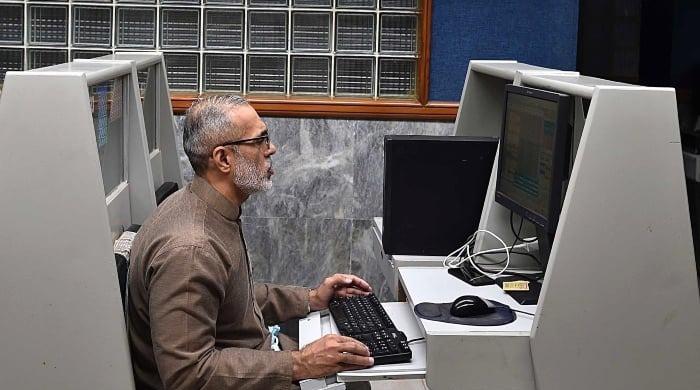

"The inquiry in the scam has discovered the monthly sales tax returns for the scam were mostly filed using IP addresses of computers in the regional tax offices," sources told The News.

Originally published in The News