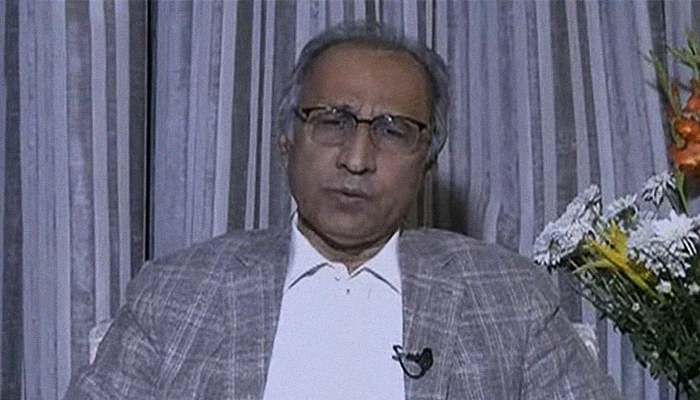

No new taxes in upcoming budget, need 'smart policy' to control expenses: Hafeez Shaikh

Shaikh said revenue collection had to be done 'carefully' and 'to increase the non-tax revenues, we have to work really hard'

May 18, 2020

KARACHI: No new taxes would be introduced in the upcoming budget, Adviser to the Prime Minister on Finance Dr Abdul Hafeez Shaikh said Monday, but suggested that Pakistan needed to adopt a "smart policy to control expenditures" amid the coronavirus crisis.

As public expenditures — including subsidies and relief measures — rise due to the pandemic and exports and remittances fall, there was an urgent need to bolster the revenues in order to 'balance' the budget.

Speaking in Geo News programme Aaj Shahzeb Khanzada Kay Sath, Shaikh, however, said revenue collection had to be done "carefully" and "to increase the non-tax revenues, we have to work really hard".

"On our external side, we have never been able to improve our exports or our FDI [foreign direct investment] in a meaningful manner throughout the 72 years of Pakistan's history," he explained. "It has been a historical weakness.

"We inherited a current account deficit of $20 billion but after hard work, we brought it down to $3 billion and that was a satisfactory trend that we wished to continue," he added.

The finance adviser noted that the incumbent PTI government faced an import bill that was almost twice of exports but it managed to bring it down. Similarly, foreign exchange reserves at the State Bank of Pakistan (SBP) rose from $7 billion to $12 billion, he stated.

Oil price crash 'in Pakistan's favour'

"The Pakistani rupee exchange rate against the dollar — which is one of the reasons why exports are not rising — was managed in a good manner," Shaikh added.

He acknowledged that the International Monetary Fund (IMF) had estimated a 3% contraction in the gross domestic product (GDP). "In the coming days, we have to work extra hard and continue the incentives — including loans, lowered utility bills, and tax refunds — that we gave to the export sector," he said.

"In the coming budget, duties on many items, including raw materials, will be cut in order to reduce the cost of doing business," he noted.

"While we are trying to bring Pakistan back to that track, we also have the real, basic demand of our people; they want relief, liquidity, food, and cash in order to dampen the negative impact on their livelihoods and also create demand."

The adviser added that one thing in Pakistan's favour was the crash in the oil prices witnessed earlier this year. The lower fuel prices would reduce the cost of doing business, he noted.

'Pakistan does not have many storage facilities'

When anchorperson Shahzeb Khanzada asked what the government has planned about hedging and future buying, considering the fact that economies around the world would open up soon and oil prices would rise again, Shaikh said: "This is a once-in-a-lifetime opportunity.

"No one can say how long the prices will remain at this level and no one can predict the trajectory or pace of recovery of the economies around the world.

"It's likely that in a few months, the current contraction will be mitigated since Pakistan does not have many storage facilities and it is not possible to store at the rock-bottom prices.

"We have decided to adopt a hedging system. Naturally, we will have to pay a fee and we have to consider a balance to pay the fixed fee," the adviser noted. "We have to see where the balance is. In two-to-four weeks, the matter will be taken up in the Economic Coordination Committee (ECC) and it will make a final decision."

In response to Khanzada's question on how the budget would be balanced given that Pakistan could not print more banknotes, a massive shortfall in tax revenue, and fiscal deficit projected to surge past 9%, Shaikh said the government was "relatively satisfied with the outgoing year, especially with the way we managed our expenditures".

'We have not given up'

"Now that our tax collection has been hit and some of our expenditure rose due to the coronavirus, it is likely that the [fiscal deficit] will cross 9%," he said. Economists and financial experts have, however, forecasted it to go beyond 10%.

"We have not given up in last two months and we will try to keep it under 9%. We have to adopt a smart policy to control expenditures in the coming year," the finance adviser said.

"We're still trying to ensure that we do not leave any step to reduce our expenditures and we have to carefully carry out the collection of revenues," he added. "It's not possible that we roll back on all the documentation or the good steps we have taken in terms of taxes.

"No new tax will be introduced in the upcoming budget. We will not do anything with respect to the taxes that will burden the industry," Shaikh said.

"We have to provide incentives to the sectors that have a high chance of job creation and that have [multiple] related industries so that the multiplier effect comes into play, which is why the construction sector was chosen.

'Privatisation goals may not be met this year'

"We will bring hundreds of tariffs to zero, keep and increase the export incentives, introduce steps for liquidity, and try to maintain the subsidies that we gave during the coronavirus crisis. That will bring good effects," he explained.

Shaikh said flexibility in the monetary policy was evident and real hard work was required to bump up the non-tax revenues. "The target for this year was Rs1.1 trillion and we are surpassing that," he added.

"Our privatisation goals may not be met this year but in the coming year, despite international configuration, we will have to work hard to get an additional $2-3 billion."

One of the two things in Pakistan's favour was a lowered borrowing cost in the coming year as opposed to the one ending, he mentioned, citing the example that when the interest rate is lowered by 1%, the benefit can go up to 100 billion.

Tax anomalies and tobacco mafia

Khanzada then highlighted how Prime Minister Imran Khan had said only three tobacco companies paid 98% of the taxes and how a "tobacco mafia" had had the tax on green leaf-threshing plants (GLTPs) reversed by lobbying against it.

"The effect of the increase in taxes is visible in the SBP's first- and second-quarter reports... the damage. Sales of illicit cigarettes increased and there was no reduction in consumption or tax revenue," the talk show host said.

To which, Shaikh said the matter was being given attention in the budget discussions.

"There are two or three ways to deal with this. First, how to stop tax collection from cigarettes from falling and secondly, how to collect revenue from counterfeit cigarettes. The results will be seen in the coming days," the adviser said.

He mentioned that the same problem was also present in other sectors, including beverage and milk companies. "These are the tax anomalies and they are being highlighted. We will resolve this," he added.

Fiscal stimulus to create consumption

Khanzada also asked Shaikh about a lower consumption pattern seen around the world following the coronavirus pandemic.

Taiwan neither had a lockdown nor did it lower its production but witnessed a fall in the consumption, the anchorperson said. Similarly, while production in both the US and China was cut back 18%, consumption slumped 26% and 27%, respectively.

The adviser responded by saying: "We fear that while demand had dipped in other countries, Pakistan's exports may not rise as they should.

"We have tried, we gave a fiscal stimulus, and the main component in the government's general approach was liquidity and cash to the people and the small- and medium-sized enterprises," he said.

Shaikh said the government had made three big decisions.

Firstly, Rs144 billion — Rs12,000 per family for 12 million households — was allocated for the deserving people under the Ehsaas Emergency Cash Programme. "Of that, Rs90 billion have already been given out very transparently and everyone can see it reaching the people," he said.

The second step was for the agriculture sector, especially the wheat farmers. "The government has bought and is buying 8.2 million tonnes of wheat and through that, Rs280 billion was given to the farmers' hands.

"This money will create more demand for tractors, food items, and other basic necessities and that will generate demand for the rest of the economy," he added.

The third decision was to hand out cash payments to the almost four million workers impacted by the pandemic.

"From today, cash payments have started. The cash transfer is being given to 16 million families and with six people per family on average, this cash transfer will be given to half of the country's population," he added, noting that that would counter the consumption crisis and contraction of the economy.

Environment 'so uncertain'

The adviser said a big challenge from when the PTI came into power were the loans it inherited from prior governments. "We had to mobilise. In the past two years, interest payments of 5 trillion have been made — 2 trillion last year and 2.7 trillion this year.

"We have tackled this issue very well," he added. "In our talks, we have obtained a $1.4 billion concessionary loan from the IMF, an additional $4.5 billion is being mobilised through the World Bank and the Asian Development Bank, and the G20 debt relief amounts to $1.8 billion in deferred payments."

With respect to remittances, Shaikh said the aggregate in the ongoing fiscal year has been more than the last comparable period. However, "there was a 6% reduction this month" since Pakistanis in the Gulf countries, UK, and the US were impacted by the coronavirus crisis.

"The whole environment is so uncertain that we cannot talk with certainty on this matter," he added.

'Have to think of a solution'

Khanzada then talked about gains of a lowered policy rate. "Usually, a lower interest rate translates to a two-pronged benefit to the private sector and the government; however, in Pakistan's history, the latter has gained much more," he said.

"Banks lend more to the government and investment in the government securities rises. More money cannot be printed and the government again will take all the benefit.

"When the goal is to incentivise the industry and have more investment [in the economy], then its necessary for the banks to lend at lower interest rate. However, that will lead to the creation of a crowding out [effect]. With so many incentives and no new taxes, the government will borrow from the banks and the banks will lend to the government and not the private sector," the anchor noted.

To which, Shaikh said: "We will have to think of a solution. We have tried to manage our debt in a good manner. Our debt cost has reduced and we have made improvements in the debt tenure/duration.

"Earlier, 46% of the loans in our total debt stock were one year or more [in terms of debt tenure]. Now, this number has risen to 72%," the adviser explained.

"At the same time, we have to talk to the banks and use the SBP's regulatory machinery. We have to try [to ensure] that banks give credit facility especially to those business that had been left out in the past.

"The government gives guarantees and the banks' risk should be calculated in some other manner. Perhaps schemes for small,- medium-, and micro-enterprises, where guarantees for 70-90% amounts are given so as to resolve the collateral issue," he added.