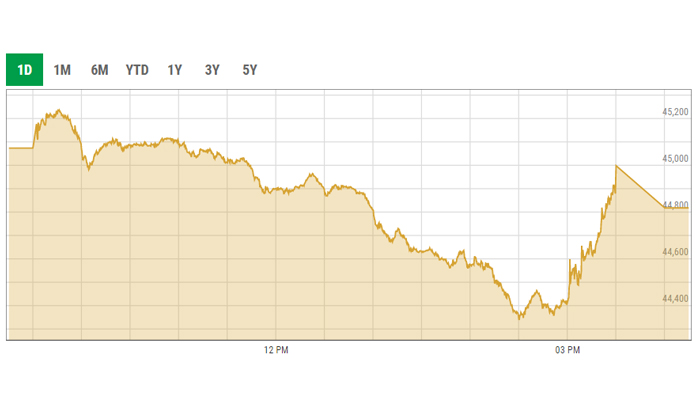

KSE-100 falls below 45,000-point mark

Benchmark index closes its seventh successive session in the red with a decrease of 255.76 points

September 27, 2021

- The KSE-100 index closes its seventh successive session in the red with a decrease of 0.57%, to settle at 44,817.76 points.

- Volumes remained thin compared to the activity in recent times, where ample volumes were witnessed in blue chips.

- Sectors contributing to the performance included banks, refinery, paper and board, investment banks and pharmaceutical.

KARACHI: Selling pressure persisted at the Pakistan Stock Exchange (PSX) for another session on Monday as the benchmark KSE-100 index fell over 250 points and closed below the 45,000-point mark.

The benchmark index closed its seventh successive session in the red with a decrease of 255.76 points or 0.57%, to settle at 44,817.76 points.

The session kicked off on a positive note, however, the market failed to sustain the gains due to a lack of investor interest and the index marched downwards. A few attempts made to reverse the direction of the market proved futile and the day ended on a negative note.

A report from Arif Habib Limited noted that the market posted gains of 163 points earlier in the session, but faced the onslaught sooner that caused the erosion of these gains and netting a loss of 732 points during the session.

"Leveraged positions mostly got a thrashing, however, depreciation of Pakistani rupee was another reason cited for the panic selling in the market," it said.

Nonetheless, selling subsided by the end of the session and the market on closing saw aggressive buying activity.

Volumes remained thin compared with the activity in recent times, where ample volumes were witnessed in blue chips.

Volumes declined from 369.5 million shares to 301.4 million shares (-19% day-on-day). The average traded value also declined by 5% to reach $65.9 million against $69.5 million.

Fertiliser, exploration and production, oil and gas marketing companies, cement stocks saw quick-paced buying by the end of the session that helped the index pull back.

Sectors contributing to the performance included banks (-101 points), refinery (-34 points), paper and board (-25 points), investment banks (-23 points) and pharmaceutical (-20 points).

During the session, shares of 547 listed companies were traded. At the end of the session, 143 stocks closed in the green, 382 in the red, and 22 remained unchanged.

Among these 547 firms, stocks that contributed positively to the index included Systems Limited (+50 points), Fauji Fertiliser (+18 points), Millat Tractor (+8 points), Kohinoor Textile Mills (+7 points) and Engro Polymer and Chemical (+7 points).

On the flip side, stocks that contributed negatively were TRG Pakistan (-51 points), HBL (-51 points), Meezan Bank (-29 points), UBL (-18 points) and Pakistan State Oil (-16 points).

Unity Foods was the volume leader with 34.9 million shares, losing Rs1.11 to close at Rs30.80. It was followed by WorldCall Telecom with 32.6 million shares, losing Rs0.11 to close at Rs2.76, and Byco petroleum with 32.2 million shares, losing Rs0.55 to close at Rs7.56.