KSE-100 makes gains despite monetary policy jitters

At close, the benchmark KSE-100 index was up 378.91 points, or 0.82%, at 46,489.41

November 19, 2021

- At close, the benchmark KSE-100 index had risen by 378.91 points, or 0.82%, at 46,489.41 points.

- Investors looked for shares offered at attractive valuations after sustained selling for the last two days.

- During the session, shares of 356 companies were traded.

KARACHI: The Pakistan Stock Exchange (PSX) posted modest gains during the pre-monetary policy announcement session, finishing the trading week in the green.

Investors looked for shares at attractive valuations after sustained selling for the last two days opened some windows.

The State Bank of Pakistan (SBP) was set to announce a new benchmark interest rate towards the end of the session, where most believed the policy rate would be increased.

Later, in line with market expectations, the central bank increased its benchmark policy rate by 150 basis points to 8.75% for the next two months.

News that technology exports were up 29% (year-on-year) in October lent support to the technology sector.

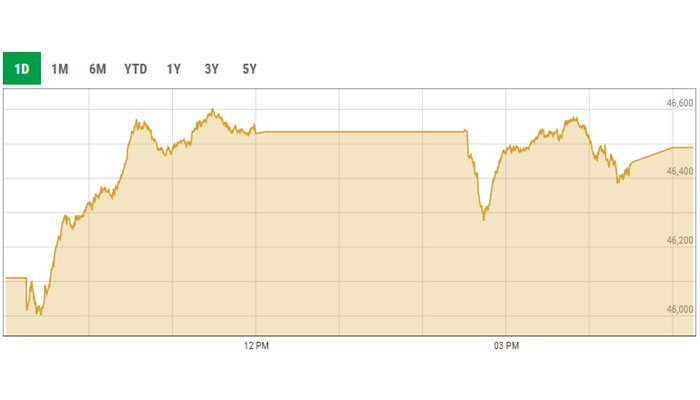

The stock market kicked off trading on a positive note and remained in the green for most of the first session. However, it receded after trading resumed in the second half, and the KSE-100 index dived but losses were recouped towards the end of the session.

A report from Arif Habib Limited noted that the market mostly stayed in the green zone today mainly led by the banking sector.

"In the first session, positive momentum was observed as investors became optimistic due to the large-scale manufacturing Industries (LSMI) output number that increased by 5.15% in the first quarter (July-September) of the current fiscal year 2021-22 compared to the same period of last fiscal year 2021, as almost all major manufacturing sectors posted growth," it stated.

The report, however, mentioned that in the second session, profit booking was observed across the board after the current account deficit (CAD) number clocked in at $1.7 billion during October 2021.

On the institutional front, accumulation was witnessed in the banking stocks.

"Going forward, MPC decision to raise the policy rate by 150 basis points to 8.75% will create volatility in the upcoming roll-over week," it predicted.

Sectors contributing to the performance included banks (178.98 points), fertilisers (102.24 points), exploration and production (68.03 points) and cement (62.03 points).

At close, the benchmark KSE-100 index had risen by 378.91 points, or 0.82%, to close at 46,489.41.

Shares of 356 companies were traded. At close of trading, 215 scrips closed in the green, 123 in the red, and 18 remained unchanged.

Overall trading volumes rose to 304.2 million shares compared with Thursday’s tally of 263.5 million. The value of shares traded during the day was Rs12 billion.

Ghani Global Holdings was the volume leader with 33.9 million shares traded, gaining Rs0.45 to close at Rs33.68. It was followed by Service Fabrics with 17.9 million shares traded, gaining Rs0.06 to close at Rs12.93, and First National Equities with 14.85 million shares traded, gaining Re1 to close at Rs11.23.