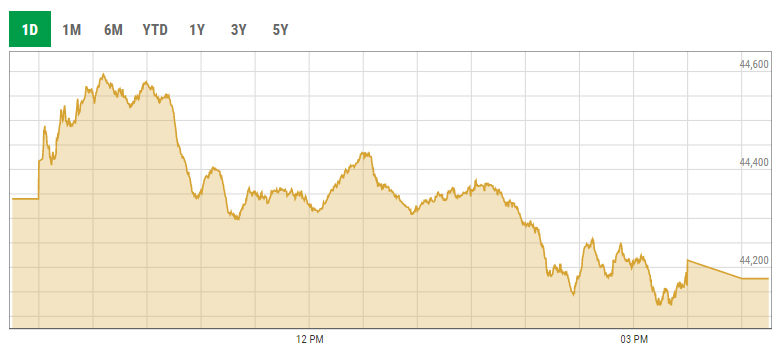

KSE-100 falls over 160 points on widening current account deficit

Widening current account deficit in November weighs on investors’ sentiments and dents their confidence

December 21, 2021

- Widening current account deficit in Nov weighs on investors’ sentiments.

- AHL says volumes remain on dull note whereas activity continue to remain side-ways.

- Shares of 346 companies were traded during the session.

KARACHI: The bears staged a comeback at the Pakistan Stock Exchange (PSX) on Tuesday as the benchmark KSE-100 index fell over 160 points.

The Widening current account deficit in November, which clocked in at $1.91 billion, weighed on the investors’ sentiments and shook their confidence.

Meanwhile, continuous depreciation of the Pakistani rupee against the local currency and anticipation of Rs400 billion mini-budget this week kept the investors on the sidelines.

Today, the benchmark KSE-100 index fell by 162.88 points, or 0.37%, to close at 44,177.07 points.

A report from Arif Habib Limited noted that the market remained choppy today as the current account number increased to $1.9 billion during November 2021.

The brokerage house stated that on a year-on-year basis, the primary reason behind the deficit was a 57% year-on-year increase in total imports to $7.3 billion.

“Profit-taking occurred in the first trading hour then the market battled between the bulls and bears throughout the day,” it said.

The report further added that the volumes remained on the dull note whereas activity continued to remain side-ways as the market witnessed hefty volumes in the third tier stocks.

Sectors contributing to the performance included exploration and production (-57 points), commercial banks (-51 points), fertiliser (-45 points), cement (-39 points) and oil marketing companies (-14 points).

Shares of 346 companies were traded during the session. At the close of trading, 145 scrips closed in the green, 171 in the red, and 30 remained unchanged.

Overall trading volumes dropped to 223.08 million shares compared with Monday’s tally of 238.45 million. The value of shares traded during the day was Rs8.68 billion.

WorldCall Telecom Limited was the volume leader with 21.7 million shares traded, losing Rs0.07 to close at Rs2.12. It was followed by TRG Pakistan with 20.92 million shares traded, gaining Rs1.83 to close at Rs116.24 and Cnergyico PK Limited with 18.7 million shares traded, gaining Rs0.36 to close at Rs6.53.