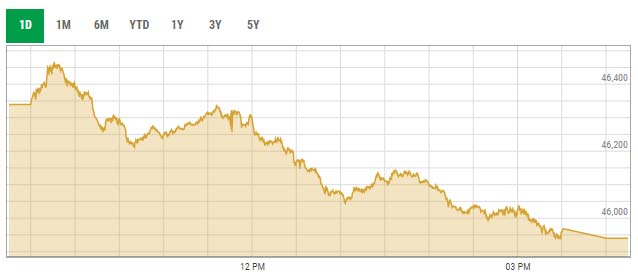

Bears pull KSE-100 index below 'psychological' level of 46,000

PSX traded between hope and despair, which eventually let loose the bears who dragged the bourse into the red

February 10, 2022

- KSE-100 index sheds 399.72 points to settle at 45,940.04.

- PSX traded between hope and despair.

- Shares of 367 companies were traded during the session.

KARACHI: The bears staged a comeback at the Pakistan Stock Exchange (PSX) on Thursday as the benchmark KSE-100 index shed nearly 400 points and closed below the 46,000-psychological mark.

The stock market traded between hope and despair, which eventually let loose the bears who dragged the bourse into the red.

Investors kept a close watch on news regarding Morgan Stanley Capital International (MSCI) quarterly review and the emerging financial results.

It is pertinent to mention here that MSCI announced changes in constituents of its global indices which would be effective from March 1, 2022. All three stocks including Lucky Cement, MCB and HBL retained their position in MSCI Pakistan index.

Meanwhile, it also added Pakistan in both MSCI FM100 and MSCI FM 15% country cap index. However, he changes in MSCI Frontier Market (FM) 100 and MSCI FM 15% country cap index same will be applicable from May 2022 Semi Annual Index Review (SAIR).

At the close, the benchmark KSE-100 index shed 399.72 points, or 0.86%, to settle at 45,940.04 points.

Arif Habib Limited in its post-market commentary noted that the market remained dull today as sustainability concerns arose over psychological level of 46,000.

“The cement sector stayed under pressure due to higher international coal prices,” it said, adding that in the fertiliser sector, Engro Fertiliser remained in the limelight as it announced financial result in line with market expectations.

The brokerage house stated that the index level of 46,000 was unable to digest by the investors as profit-taking was observed across the board in the last trading hour, which led the market to close in the red zone.

Sectors contributing to the performance included banks (-120.6 points), fertiliser (-63.2 points), technology (-57.5 points), exploration and production (-42.7 points) and cement (-35 points).

Shares of 367 companies were traded during the session. At the close of trading, 123 scrips closed in the green, 222 in the red, and 22 remained unchanged.

Overall trading volumes rose to 285.96 million shares compared with Wednesday’s tally of 243.1 million. The value of shares traded during the day was Rs9.27 billion.

Telecard Limited was the volume leader with 45.4 million shares traded, losing Rs0.33 to close at Rs17.51. It was followed by TPL Properties with 16.9 million shares traded, gaining Rs0.30 to close at Rs34.19, and World Call Telecom Limited with 13.71 million shares traded, losing Rs0.03 to close at Rs2.18.