KSE-100 falls owing to bearish global markets

Trickle-down effect stock selling in international markets was felt in Pakistan as well where KSE-100 shed 435 points

February 14, 2022

- Trickle-down effect stock selling in international markets was felt in Pakistan as well.

- At close, KSE-100 index shed 435.28 points to settle at 45,644.09.

- Shares of 349 companies were traded during the session.

KARACHI: The bears on Monday gripped the Pakistan Stock Exchange as a dip in international stock markets — driven by fears that Russia could invade Ukraine at any time — drove oil prices to seven-year peaks, impacted trading at the local bourse.

The United States on Sunday said Russia might create a surprise pretext for an attack, as it reaffirmed a pledge to defend "every inch" of NATO territory, which renewed fears of a further hike in oil prices and triggered stock selling in the international markets.

Its trickle-down effect was felt in Pakistan as well where the benchmark KSE-100 share index shed 435 points.

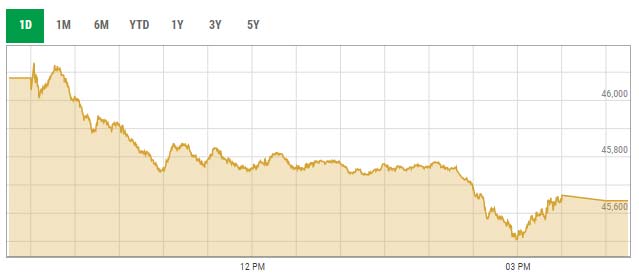

Earlier, the trading session kicked off on a positive note, however, selling pressure pulled it down and the market was trading with minor ups and downs towards midday. Acceleration in profit-taking towards the end of trading dragged the index into the red zone and as a result, it closed with a handsome loss.

At the close, the benchmark KSE-100 index shed 435.28 points, or 0.94%, to settle at 45,644.09 points.

Arif Habib Limited in its post-market commentary noted that a bloodbath session was witnessed today as crude oil prices surged to a seven-year high in the international markets amid intensifying tensions between Ukraine and Russia.

The cement sector stayed under pressure due to higher international coal prices.

The brokerage house reported that across the board selling was recorded as investors opted for a risk-averse approach.

"Mainboard activity remained dull. On the flip-side, activity continued to remain side-ways as the market witnessed hefty volumes in the third tier stocks," it said.

Sectors contributing to the performance included commercial banks (-76.6 points), technology (-63.1 points), fertiliser (-53.6 points), cement (-42.6 points) and engineering (-31.9 points).

Shares of 349 companies were traded during the session. At the close of trading, 58 scrips closed in the green, 273 in the red, and 18 remained unchanged.

Overall trading volumes plunged to 187.8 million shares compared with Friday’s tally of 170.62 million. The value of shares traded during the day was Rs5.94 billion.

WorldCall Telecom Limited was the volume leader with 33.53 million shares traded, losing Rs0.10 to close at Rs2.05. It was followed by Telecard Limited with 9.87 million shares traded, losing Rs1.05 to close at Rs16.32, and Ghani Global Holdings with 7.8 million shares traded, losing Rs1.28 to close at Rs20.50.