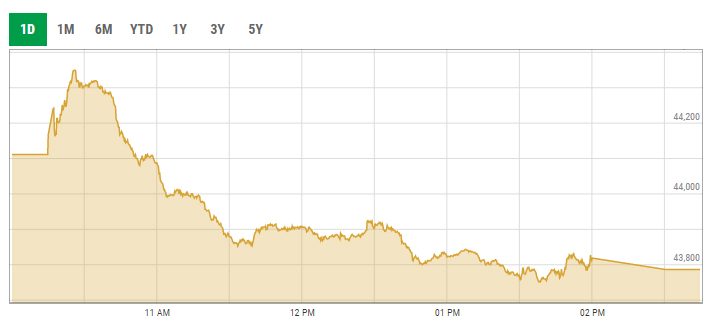

Bears push KSE-100 index below 44,000-barrier

Weak investor sentiment amid rupee depreciation sparks profit-taking in all index-heavy sectors and pulled the market down

April 07, 2022

- Weak investor sentiment amid rupee depreciation sparks profit-taking in all index-heavy sectors.

- KSE-100 index shed 324.27 points to close at 43,786.83.

- Shares of 308 companies were traded during the session.

KARACHI: The bears staged a comeback at the Pakistan Stock Exchange (PSX) as the benchmark KSE-100 index loses over 300 points owing to rupee depreciation and rising political crisis.

The ongoing decline in the rupee’s value against the greenback caused worries among market participants as investors offloaded stocks and remained on the sidelines.

Weak investor sentiment sparked profit-taking in all index-heavy sectors and pulled the market down.

Earlier, trading kicked off on an optimistic note, but due to the absence of positive triggers, the market erased gains and started descending in the initial hour. Following a steady decline, the downward trend accelerated in the final hours, pushing the index below 44,000 points.

Today, the benchmark KSE-100 index shed 324.27 points, or 0.74%, to close at 43,786.83 points.

A report from Arif Habib Limited in its post-market commentary noted another volatile day was observed in the stock market today.

“The benchmark KSE-100 index opened positive but was unable to digest green zone due to ongoing political unrest, rising T-bill auction yields and Pakistani rupee devaluation against the US Dollar,” the brokerage house noted.

It further stated that the cement sector stayed under pressure throughout the day. Across the board, profit selling was witnessed in the last trading hour which led the index to close in the red zone.

Sectors contributing to the performance included banks (-105.4 points), cement (-54.6 points), power (-32.6 points), exploration and production (-31.1 points) and engineering (-30.8 points).

Shares of 308 companies were traded during the session. At the close of trading, 93 scrips closed in the green, 193 in the red, and 22 remained unchanged.

Overall trading volumes rose to 141.01 million shares compared with Wednesday’s tally of 108.41 million. The value of shares traded during the day was Rs4.98 billion.

Ghani Global Holdings was the volume leader with 11.14 million shares traded, gaining Rs0.33 to close at Rs16.50. It was followed by Pak Elektron with 9.24 million shares traded, gaining Rs0.27 to close at Rs16.55 and K-Electric with 7.69 million shares traded, losing Rs0.01 to close at Rs7.69.