Should Pakistan’s economy be compared with Sri Lanka’s?

Predictions of default, bankruptcy and similarity with Sri Lanka are jarring the equity, debt and currency markets

May 27, 2022

A state of uncertainty, almost at the verge of panic, prevails today in Pakistan. Prophets of gloom and doom using social and electronic media are spreading all kinds of fake, negative, partial and partisan stories and numbers.

Predictions of default, bankruptcy and similarity with Sri Lanka are jarring the equity, debt and currency markets and pushing the credit default rates on Pakistani bonds in international markets to unprecedented elevated yields, making it difficult to tap these markets.

However, one should present the facts and data unvarnished and untarnished. Yes, we are facing a large current account deficit that is putting pressure on our exchange rate and consequently interest rate. In the absence of FDI inflows and large amortization payments, we have to resort to increased borrowing – both short term and commercial – that adds to our already high debt stock and also draws down on our foreign exchange reserves.

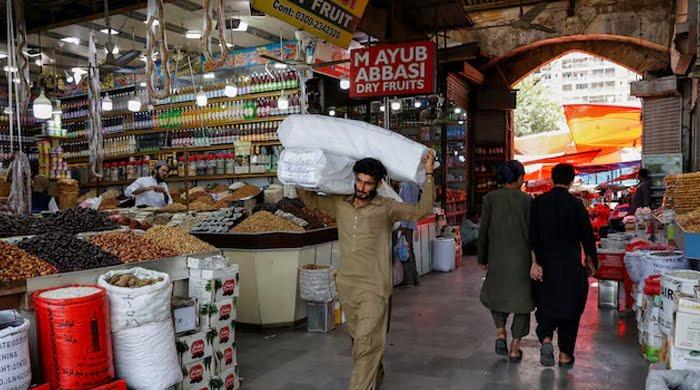

Reserves have depleted to cover only six-weeks imports; that brings speculators to the currency market, accentuating the pace of depreciation . Inflation rates have exceeded the norm and cumulative rise in prices of 40 per cent in the last four years are hurting fixed income earners as their salaries and wages have not kept up with the rate of inflation. These are all matters of serious concern and should be handled carefully and tactfully as there are serious tradeoffs involved.

At the same time, the growth rate for the last two years has been around six per cent, agriculture incomes due to higher domestic prices of agricultural commodities have risen by Rs1100 billion last year, corporate profits have risen by almost 50 per cent, higher remittances have added Rs500-600 billion as additional transfers to poor or low-income families. Cash transfers of over Rs200 billion to households living below the poverty line under BISP have smoothed the consumption of poor and vulnerable groups. This additional purchasing power has resulted in a 10 per cent growth in large-scale manufacturing, higher employment levels, exceptional demand for private-sector credit and reduction in poverty.

Export growth of goods has risen by 25 per cent; ICT exports have more than doubled; FBR revenues have escalated 30 per cent – a record never achieved before. Tax refunds to exporters have been automated and Rs350 billion disbursed within the specified time easing the liquidity pressure. Competitive energy prices have leveled the playing field for exporters, relative to neighbouring countries.

It may be pertinent to recall, especially for the younger generation, that this is not the first time Pakistan has faced such a crisis situation. Just in the last 20 years we were confronted with similar or even worse situations in 1998-99; 2008; 2013; and 2018-19.

Just to refresh the memory of one such crisis, let us revisit 1998/99. After the nuclear testing in 1998 and the freezing of the foreign exchange accounts of residents and non-resident Pakistanis, amounting to $11 billion and the sanctions imposed by the Western countries, there was a severe loss of confidence in the economy. By December 1999, Pakistan didn’t have enough foreign exchange to clear the letters of credit for oil shipments anchored outside Kemari. Liquid usable foreign exchange reserves were only $300 million that hardly sufficed to meet one week of imports. Further economic sanctions were imposed after the military coup in October 1999.

The country was in worse shape than we are facing today. The majority of today’s young population was not born or was in infancy stage – so they are not aware of the calamitous situation that prevailed then. To them, rightly, the current economic situation is an unnerving experience. The economy showed resilience and bounced back. By 2008, the foreign exchange reserves had risen to $16.5 billion equivalent to six months of imports. Exports doubled from $8.6 billion to $17 billion, and the current account was surplus in three out of seven years. External debt-to-GDP ratio was halved from 47.6 per cent to 27.8 per cent. FDI inflows amounted to over $5 billion by 2007. GDP growth averaged over six per cent.

The country completed the IMF programme successfully ahead of schedule and did not draw down the last two instalments as there was no need to do so. Unlike those who attribute these achievements to the fallout of the ‘war against terror’, evidence shows that the withdrawal of sanctions, and financial flows mostly reimbursement of expenditures incurred in support of coalition forces did help but it was the macroeconomic stability that restored the confidence of the domestic and foreign investors. The global financial crisis of 2008 along with the unfortunate decision taken by the caretaker government not to pass through oil and food import prices to consumers created another crisis in 2008.

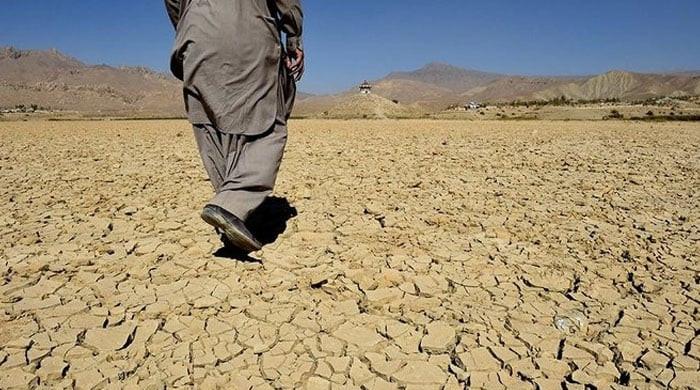

The present crisis is unique as it is shrouded in political instability, deep cleavages and polarization in society, powerful social media bombarded with fake news; an adverse external environment and supply disruptions caused by the pandemic, the Ukraine war, sanctions against Russia, interest rate hikes in advanced countries, lockdown in China; and impact of climate change (heatwaves) .

The history of crises shows that these take place every time we witness an upsurge in the aggregate demand as purchasing powers rise due to economic growth particularly when per capita incomes have risen, businesses are expanding and purchasing power is on an upward incline. The country does not have sufficient capacity to produce petroleum or refined products, machinery and equipment, chemicals, iron and steel, raw materials for industry not even for pulses, vegetable oil, milk powder. As the domestic productive capacity is unable to meet this demand, it spills over into higher imports. Non-debt creating earnings such as exports of goods and services, workers’ remittances and foreign direct investment fall short of the outflows on account of higher imports, and debt servicing creating imbalances in the balance of payments.

The question that needs to be addressed to break this vicious cycle is: how do we revive and accelerate the rate of growth without creating pressure on balance of payments, while keeping inflationary expectations subdued, generating maximum employment opportunities and assisting the poorer segments of the population?

This fine balancing act is itself difficult from a political economy perspective but is further compounded by our being under an IMF programme which is essential to meet our external financing needs and maintain international confidence. The pathway we have to adopt is to have a systematic, collaborative approach in which the federal ministries, provincial governments, financial sector and private-sector players work together on an agreed agenda, identifying priorities, targets to be achieved, responsibilities assigned, with timelines. This agenda needs to be disseminated and communicated widely. The recent success of the National Coordination Committee on Covid-19 provides the platform for monitoring progress, taking remedial actions and holding people accountable for results.

The institutional arrangement that we propose to bring coherence, complementarity, and consistency between the federal and provincial governments is to make the National Economic Council (NEC) – a constitutional body under Article 156 – more effective so it can live up to its mandate. Prior consultations should be held with credible private-sector organizations. The NEC should meet every quarter to review and monitor progress on the agreed economic and sectoral agenda and take corrective measures where needed.

To be continued.

The writer is the author of 'Governing the ungovernable'.

Originally published in The News