Pakistan's IMF programme hinges on govt's ability to make fiscal adjustments: report

IMF seeks fiscal adjustments of about 2.5% of GDP by increasing revenues in upcoming budget 2022-23

June 02, 2022

- The restoration of Pakistan's delayed IMF programme rests on the government's capacity to make fiscal adjustments.

- The government must end petrol subsidies of Rs39 per litre and diesel subsidies of Rs53 per litre, as per IMF requirement.

- The staff-level agreement with the IMF expected to be struck by mid-June 2022.

ISLAMABAD: The restoration of Pakistan's delayed IMF programme rests on the government's capacity to make fiscal adjustments of about 2.5% of the GDP, or Rs2,000 billion, by increasing revenues and reducing expenditures in the upcoming budget 2022-23, The News reported Thursday.

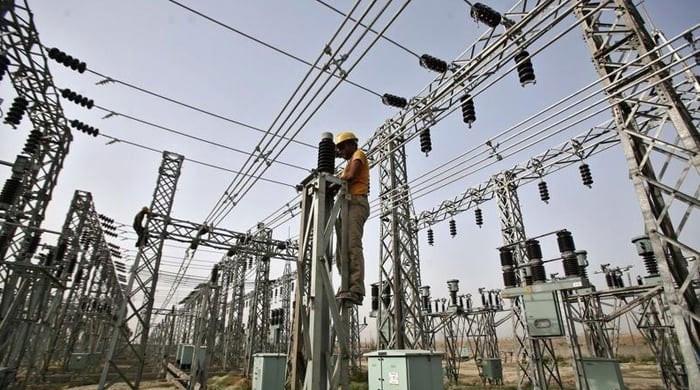

The IMF's wish-list or demands do not end here, as the government must end petrol subsidies of Rs39 per litre and diesel subsidies of Rs53 per litre, raise electricity tariffs by Rs8 per unit via an increase in base tariff and fuel price adjustments, and increase gas tariffs by 20% on average to demonstrate its commitment to implementing the much-needed 'reforms agenda' under the advice of the IMF programme.

Finance Minister Miftah Ismail told the publication on Tuesday night that the staff-level agreement with the IMF was expected to be struck by mid-June 2022. It indicates that the staff-level agreement is expected only after the announcement of the next budget for 2022–23, in line with the IMF programme's objectives.

However, sources said that the IMF has asked for steep and rapid adjustments on the fiscal front in order to bring the economy back on the stabilisation path. The announcement of the next budget for 2022-23 aligned with IMF policies will set the stage for a stabilisation path, but here is the catch-22 situation: the government will have to take tough decisions, instead of doling out resources to gain political support.

In such a scenario, the IMF is asking to jack up FBR’s tax collection target up to Rs7.5 trillion for the next budget and reduce development funds as well as subsidies. The fiscal deficit is all set to escalate to close to Rs5,000 billion, or 7.4% of the GDP, and now the IMF is asking to bring it down to 4.9% of GDP for the next fiscal year. The FBR will have to collect additional taxes of Rs1,200 to Rs1,500 billion in the next fiscal year to make the fiscal framework sustainable and prudent in line with the IMF prescriptions.

On the expenditure side, it is yet to be seen how the government will find resources to increase salaries and pensions in the range of 10 to 15% for mitigating the difficulties of inflation-stricken fixed income groups living in urban areas.

Although, the government preferred to keep the POL prices unchanged at the existing level from June 1, 2022, it will have to pass on the burden to consumers after the announcement of the budget.

The latest estimates suggest that despite raising the POL prices by Rs30 per litre, the subsidy on petrol stood at Rs39 per litre, which was earlier standing at Rs17 per litre after raising the prices on May 27, 2022.

It's ironic that the sale of petroleum products went up by 28% in May 2022 in comparison with the same month of the last fiscal year. The POL products sales increased by 18% in the first 11 months of the current fiscal year compared to the same period of the last financial year.