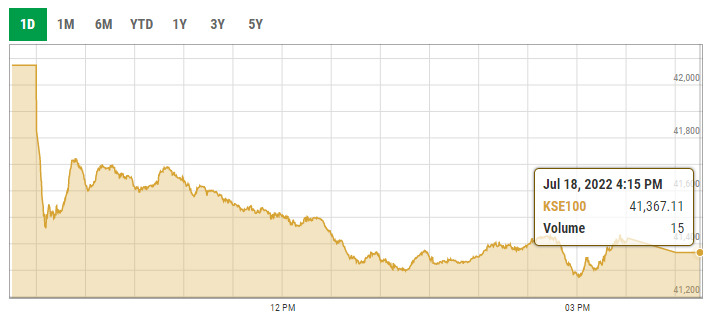

Stocks take hammering as KSE-100 plunges nearly 750 points on negative cues

KSE-100 plunges by 1.68% to close at 41,367.11 points amid political uncertainty

July 18, 2022

- KSE-100 plunges by 707.80 points.

- Index closes at 41,367.11 points.

- Political uncertainty plunges market.

KARACHI: The stocks at the Pakistan Stock Exchange (PSX) plunged Monday as its benchmark KSE-100 lost over 700 points after uncertainty surrounded Pakistan’s political arena.

Investors reacted with panic to the depreciating Pakistani rupee against the US dollar and political uncertainty in the wake of the preliminary results of the by-polls in Punjab.

The market opened at 42,074 points but it plunged by 707.80, or 1.68%, points to close at 41,367.11 points.

Arif Habib Limited Head of Research Tahir Abbas told Geo.tv that “a lot of ifs and buts” have been created as the PTI has cracked more seats than the ruling PML-N in the Punjab Assembly by-polls.

“Following the results of the by-polls, there’s an uncertainty in the market on whether the federal coalition government will continue or will it announce snap polls.”

“If early elections are announced, then it would trigger uncertainty over the International Monetary Fund’s (IMF) curial programme as well,” he said, pointing out that although a staff-level agreement has been reached, the global lender's Executive Board is yet to give a green signal.

Abbas said that one of IMF’s pre-conditions was hiking the gas and electricity tariff, for which the federal cabinet is yet to give approval.

“Now that it (PML-N) has lost its heart — Punjab — it remains unclear what it is going to do next. If the federal cabinet does not approve the hike, then the IMF programme’s revival will remain in danger.”

Voicing the same concerns as Abbas, Alpha Beta Core CEO Khurram Schehzad said that with political uncertainty taking roots again, IMF programme may get impacted.

“Hopefully [...] clarity emerges soon before its late,” Schehzad said.

In its post-market commentary Arif Habib Limited stated that the market opened in the negative zone and remained under pressure throughout the day as investors opted for panic selling due to the rupee devaluation against US dollar.

"The main board volumes remained dull although hefty volumes were observed in the third-tier stocks," it noted.

Sectors contributing to the performance included banks (-127.6 points), cement (-106.6 points), fertiliser (-106.2 points), exploration and production (-69.1 points), and technology (-67.9 points).

The stocks of a total of 326 companies were traded during the day, out of which 55 were in the green, 253 red, and 18 remain unchanged.