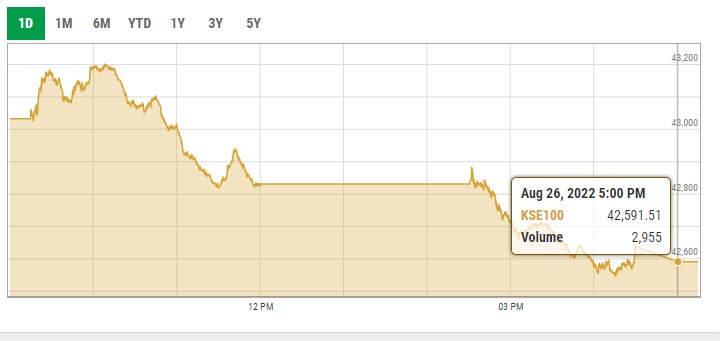

KSE-100 ends rollover week in red, falls below 43,000-point mark

Taking cue from gloomy macroeconomic outlook, bulls remained on sidelines while bears dominated market

August 26, 2022

- Benchmark KSE-100 index slumped over 400 points.

- Bulls chose to remain on sidelines while bears dominated the market.

- Shares of 331 companies were traded during the session.

KARACHI: The Pakistan Stock Exchange (PSX) witnessed another round of thrashing on the last day of the rollover week as investors continued to mourn the rupee depreciation and political uncertainty in the country.

The benchmark KSE-100 index slumped over 400 points to tumble below the 43,000 point level.

Taking cue from the gloomy macroeconomic outlook, bulls chose to remain on the sidelines while bears dominated the market.

Speculations over the executive board meeting of the International Monetary Fund (IMF), scheduled to be held on August 29, to release the next tranche of the loan, instilled fears among investors and triggered an across-the-board selloff at the bourse.

The decline in foreign exchange reserves on a weekly basis coupled with a surge in weekly inflation further dented the confidence of the market participants.

Trading began with a short-lived rally as the index failed to sustain its upward march and succumbed to the selling pressure. The market remained in the red zone for the rest of the session and fell steadily until close.

At close, the benchmark KSE-100 index closed at 42,591.51 points with a decrease of 441.06 points or 1.02%.

A report from Arif Habib Limited noted that a negative session was witnessed at the PSX due to the last day of rollover week as investors opted for profit-taking.

The brokerage house stated that the first session consisted of dull activity despite the opening in the green zone. However, in the second session investors opted for profit taking which hammered the index to close in the red zone.

“Mainboard volumes stayed dry,” it said, adding that on the contrary, hefty volumes were observed in the third-tier stocks.

Sectors contributing to the performance included banks (-85.5 points), technology (-64 points), oil marketing companies (-61.1 points), exploration and production (-48.3pts) and cement (-37.7 points).

Shares of 331 companies were traded during the session. At the close of trading, 90 scrips closed in the green, 218 in the red, and 23 remained unchanged.

Overall trading volumes rose to 266.75 million shares compared with Thursday’s tally of 208.11 million. The value of shares traded during the day was Rs9.03 billion.

K-Electric was the volume leader with 50.61 million shares traded, gaining Rs0.12 to close at Rs3.51. It was followed by Pakistan Refinery with 16.78 million shares traded, gaining Rs19.08 to close at Rs19.08 and Pak Elektron with 13.09 million shares traded, gaining Rs0.30 to close at Rs16.72.