PSX races ahead fuelled by energy sector

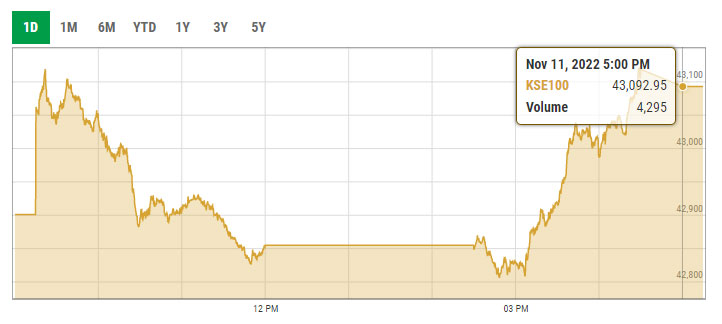

KSE-100 index closes at 43,092.95 points after securing 191.68 points or 0.45% at PSX

November 11, 2022

- Investors bet on combined $13bn Saudi-China funding.

- TRG Pakistan, Oil and Gas Development Company lead gains.

- Analysts advise investors to adopt buy-on-dips strategy.

KARACHI: Stocks forged ahead Friday fuelled by energy and technology sectors amid optimism that bilateral funding, likely this month, would give the uptight fiscal side much-needed relief, reflecting positively on the economy.

The KSE-100 shares index closed at 43,092.95 points after securing 191.68 points or 0.45% at Pakistan Stock Exchange (PSX).

Darson Securities in its market review said the indices extended gains. “The benchmark index hit the intra-day low at 42,805.88 level, but later in the day it managed to recover as mammoth buying seen in technology and energy sectors,” the brokerage said.

Going forward, we recommend investors adopt a buy-on-dips strategy in the cement, banking, and energy sectors, JS Research said in a note.

Topline Securities said the market largely traded in a positive zone where major contributions came from TRG Pakistan, Oil and Gas Development Company, Pakistan Petroleum Limited, Pakistan State Oil, and Nestle Pakistan, as they cumulatively added 256 points to the index.

Pakistan Services Limited, Hub Power Company Limited, Fasial Bank Limited, Bank Al-Falah and Thal Limited together dented the index by 61 points. Volumes decreased 20% from Thursday’s 293.9 million shares to 232.8 million. Cnergyico PK Limited was the volume leader with 21 million shares.

Arif Habib Ltd (AHL) said yet another positive day was witnessed at the PSX today.

“The market opened in the positive territory although lacklustre activity led the index to lose 96.39 points at the close of the first trading half; However, the benchmark index bounced back once the trading resumed,” the brokerage said.

The AHL report added that investors resurfaced following the finance minister’s announcement of a $13 billion package from China and Saudi Arabia. “Volumes were stable overall, while healthy activity was observed in the oil and exploration companies,” it reported.

Sectors contributing to the performance were exploration and production (+129.3 points), technology and communication (+98.4 points), oil marketing companies (+22.8 points), tobacco (+13.1 points) and food and personal care products (+12.8 points).