The future of Pakistan's economy - Part III

Footprint of the govt has to be reduced and tax-to-GDP ratio raised to 15% by bringing in people who are outside tax net

December 09, 2022

Coming to the third structural reform: investment rates have lingered around 15% of GDP in the last decade thus constraining the rate of growth. Savings rates are dismally low for a variety of reasons. Private household consumption expenditure is relatively high, and fiscal deficits are high, lowering the national savings rate by at least five percentage points. Public-sector borrowing from the banks crowds out private-sector credit for fixed capital, financial intermediation is weak and access to finance is limited.

The footprint of the government has to be reduced and the tax-to-GDP ratio raised to 15% of GDP by bringing in those individuals and companies who are outside the tax net. This can be done by the provinces taxing sectors such as large holdings in agriculture, urban immovable property, and services. Capital markets are shallow with very little participation of retail investors. Government securities are bought and sold only by a select number of banks.

Digitalisation can play a useful role in mobilising savings from those who are outside the current banking system. By reducing fiscal deficit, strengthening capital markets and promoting inclusive banking through digitalisation, the domestic savings ratio can gradually rise to 20% as our neighbouring countries have shown by reaching 30% of GDP. This would minimise our heavy dependence on foreign savings, particularly in the form of debt and also the recourse to the IMF would be exceptional rather than a norm.

Four, the balance of payments crises can cease to exist (except for unanticipated exogenous shocks) if an outward-looking strategy that promotes exports of goods and services, FDI, workers’ remittance, and integrates Pakistan into the world economy is pursued consistently. We haven’t tapped the world’s largest market — China — and we should aim to capture at least 1% of their market by 2030. This alone would double our total exports and create a comfortable cushion in the form of foreign exchange reserves which can be tapped during rainy days.

Tariff and non-tariff barriers have to be dismantled thus helping the businesses to become cost competitive and enabling the firms to take part in global value chains. The anti-export bias has to be significantly removed and export promotion should remain the stated policy objective. Raw materials, components, machinery and equipment, consumer goods should be allowed to enter the country free of restrictions. Import substitution in agricultural commodities where Pakistan enjoys dynamic comparative advantage should be encouraged through productivity enhancement measures and removing price distortions.

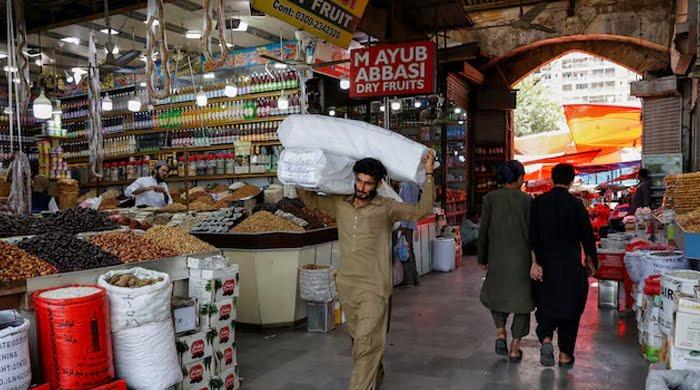

Five, the private sector is the main vehicle for producing and exchanging goods and services for the domestic economy as well as the rest of the world. Prices should be determined by the market forces and not controlled by the government, except monopolies that are to be regulated by independent agencies. A regulatory guillotine to eliminate obsolete and unnecessary rules and regulations at all three levels of the government should take place. Integrated single-window portals that minimise the interaction between a plethora of government functionaries and the business owner would ease and reduce the cost of doing business. The pharma industry, which has the potential for becoming one of the larger foreign exchange earners, is beset with unnecessary price controls. The telecom industry is facing problems of taxation and spectrum pricing which is impeding private sector and foreign investment in the sector. These issues have to be resolved amicably.

Six, the role of the state is to provide security of life and property, have an independent judiciary that can arbitrate disputes and enforce contracts, build physical infrastructure, nurture human skills and train manpower and maintain an enabling macroeconomic and regulatory environment in which businesses can flourish. The government should not indulge in activities which the private sector or NGOs can do better. The role of tax authorities has to be drastically altered through automation, computerisation and digitisation along with the integration of third-party databases obviating the need of any physical interaction between the taxpayer and the tax collector and minimising the opportunities for harassment of existing taxpayers.

Surveys show that businesses do not wish to enter the tax net because of their apprehension of harassment and rent seeking by the tax authorities. The use of data analytics would go a long way in attaining this goal along with simplification of tax codes and rules. Eventually, the tax rates could be reduced without affecting the buoyancy of tax collection, and the withholding tax regime and non-adjustable advance tax regimes can also be eliminated.

Seven, privatisation of state-owned enterprises (SOEs) and the process of restructuring of those enterprises that are to be retained by the government for strategic reasons should be accelerated. Selling these enterprises to private entrepreneurs or contracting out management and operations to them while retaining the assets would stop the stress on public finances and also contribute to reduction in fiscal deficit, government borrowings and guarantees and allow the banking system to channel its deposits into productive private sector enterprises.

Energy distribution companies in electricity and gas should be opened up to the private sector and competitive markets with multiple buyers and multiple sellers free of any price controls by the government. Consumers and businesses are paying for inefficiencies and leakages of these state-owned companies while the government is accumulating trillions of rupees in circular debt.

Eight, a liberal foreign exchange regime should be maintained on a consistent and predictable basis to attract FDI, particularly in export-oriented manufacturing sectors. Joint ventures and transfer of technology must be made an essential part of bilateral investment agreements. Foreign investors should be free to bring in and repatriate capital, dividends, profits, remittances, royalties, etc without any approvals. Foreign companies, individuals, multinational corporations can own 100% shares in locally incorporated or unincorporated firms, except for strategic or defence industries.

The ICT industry should be given priority in matters of foreign exchange transfers and transmission. The more easily they can carry out international transactions without obtaining multiple approvals, the better off will be the inflows of foreign exchange earnings. These firms should not face any difficulties in setting up marketing offices abroad. Tech companies should be facilitated in raising equity through national stock markets, private placements and venture capital funds.

Nine, the value of Pakistani currency in relation to other foreign currencies should be determined through supply and demand in the foreign exchange markets and not by administrative fiat of the State Bank. A free-floating exchange rate policy is being pursued at present and any interventions by the central bank to defend any predetermined exchange rate would have a highly pernicious effect.

Ten, interest rates are determined by an independent Monetary Policy Committee (MPC) established under the SBP Act. Benchmark rates such as Karachi Interbank offer rates are used by banks to charge the spreads according to risk assessment of the borrowers. Directed credit schemes to priority sectors such as agriculture should remain discontinued, replaced by incentives and market competition. The new law now does not allow the government to borrow from the central bank.

Eleven, consumers must have the choice to purchase foreign goods or domestically produced goods. Both of them should enjoy a level playing field in terms of tariff, taxation, and regulation. This would compel the domestic manufacturers to improve quality and reduce the prices of their products or face extinction at the hands of imported goods. Industry competitiveness will be boosted by unhindered availability.

The writer is the author of 'Governing the ungovernable'.

Originally published in The News