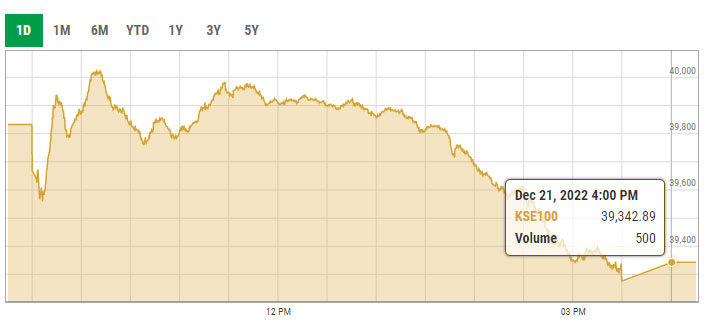

490-point plunge pushes PSX to over two-year low level

Investors continue to practice their dump-and-run approach as KSE-100 index falls nearly 500 points

December 21, 2022

- Investors continue to practice their dump-and-run approach.

- KSE-100 index falls nearly 500 points to settle at 39,342.89.

- Shares of 329 companies were traded during the session.

Investors continued to practice their dump-and-run approach as the KSE-100 index fell nearly 500 points, falling to a 26-month low level with political uncertainty and lack of positive triggers doing enough to push stocks deep in the red.

The KSE-100 index — a benchmark for market performance — underwent selling pressure from the word go, dipping to a low of 39,276.70 points with volumes remaining on the lower side.

At close, the benchmark KSE-100 index fell by 489.56 points, or 1.23%, to settle at 39,342.89 — this is the lowest level after November 2, 2020.

Market talk suggested that the ongoing uncertainty regarding the no-confidence motion against Punjab Chief Minister Parvez Elahi is the chief reason behind investors’ dump-and-run approach at the Pakistan Stock Exchange (PSX).

The index has been under immense pressure since the last week when former prime minister Imran Khan announced that the Pakistan Tehreek-e-Insaf will dissolve Punjab and Khyber Pakhtunkhwa assemblies on December 23, which was widely seen as a negative for stock market investors.

Subsequent heavy net selling by foreign investors, coupled with the constant depreciation of the rupee and delay in the International Monstery Fund programme, has led to panic selling with the index shedding close to 5% in the last three sessions.

Analysts and followers expect that the stock market is likely to remain under pressure unless clarity emerges on the political front.

Arif Habib Limited, in its post-market commentary, stated a negative session was witnessed at the PSX today.

The benchmark KSE-100 index recorded a lacklustre session as investor participation remained low due to ongoing political unrest, with the index shedding 555.75 points during intra-day in the main board. However, decent volumes were recorded in the third-tier stocks.

Sectors contributing to the performance included commercial banks (-159 points), technology and communication (-106.4 points), fertiliser (-71.2 points), exploration and production (-52.2 points), and oil marketing companies (-24.4 points).

Shares of 329 companies were traded during the session. At the close of trading, 115 scrips closed in the green, 195 in the red, and 19 remained unchanged.

Overall trading volumes fell to 166 million shares compared with Tuesday's tally of 265.28 million. The value of shares traded during the day was Rs4.05 billion.

WorldCall Telecom Limited was the volume leader with 17.47 million shares traded, losing Rs0.01 to close at Rs1.16. It was followed by Hum Network with 11.87 million shares traded, losing Rs0.02 to close at Rs5.60 and Dewan Farooque Motors with 8.57 million shares losing Re1 to close at Rs11.47.