Budget blues: Courting a perpetual deficit

Upcoming budget should have been about addressing fiscal deficit and expanding tax net — but what we are getting is same old plans that have consistently failed

The National Economic Council(NEC) has set an economic growth target of 3.5% for the upcoming fiscal year — further substantiated by the Economic Survey of Pakistan.

The recently concluded census suggests a population growth rate of 3.6%, which is one of the highest in the world. Population growth continues to outpace GDP growth, thereby resulting in a contraction in output on a per capita level.

More than a quarter of children in Pakistan are malnourished, and as the population continues to increase at an incredibly high growth rate, the number of malnourished children is only going to increase, as the government cares little for its people.

The NEC also proposed a development budget of Rs2.7 trillion, which is excessively expensive considering the sovereign's continued use of constrained budgets and large fiscal deficits.

Things may get even worse in the months to come if the strategy is to keep borrowing money to close fiscal deficit, spend trillions on development, and not widen the tax net.

It is also proposed that the salaries of most government employees are to be increased by 30%, and justifiably so, considering inflation.

This will however lock in a wage spiral, which will further feed inflation. The overall cost of running the government is only going to increase further, thereby resulting in an expanding fiscal deficit, which will be funded by debt.

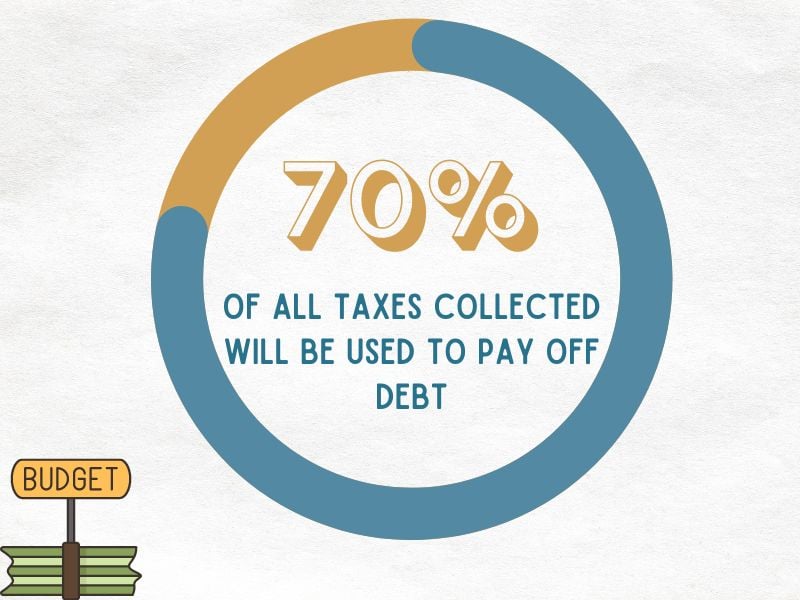

The sovereign faces a significant debt issue. It is anticipated that more than 70% of all taxes collected will be used to pay off debt, leaving very little for state operations and development spending.

In a climate where the nation is reeling under historically high inflation, surpassing 38% on a year-on-year premise, while interest rates hover around 22%, taking on more debt to bridge a fiscal deficit is only going to get more expensive.

As the government takes on more debt to bridge its fiscal deficit, the higher cost of that debt will further squeeze any available fiscal space, eventually leading to a debt spiral, where we pile up more debt to finance interest payments on existing debt stock.

Like previous budgets, the upcoming one lacks imagination.

The expected fiscal deficit for the upcoming fiscal year is Rs6 trillion, but if the past is any indication, we are going to go see a much higher number, particularly when the wage spiral kicks in.

At peak interest rates, borrowing more debt would effectively mean paying off existing debt and the markup that comes with it. The sovereign encroaches further on the private sector's space as it accumulates additional debt.

A development methodology planned around taking more debt will ultimately prompt difficulty, as capital availability will get scarcer, and the government will have to pay a higher interest rate to access more debt.

The government expects inflation for the upcoming fiscal year to be in the range of 21%, largely because of higher base-effect kicking in. However, if the government keeps on printing more money to fund its deficits, inflation is only going to get higher and stay well above the expected levels.

As the overall quantum of debt continues to increase, it may be not too far-fetched to consider a possibility of a restructuring of local debt, or a further increase in tax rates, that may hurt the fiscal stability of the financial system, as debt reaches an unsustainable level, and capital becomes scarcer.

The sovereign's ability to manage its finances is becoming increasingly limited. The upcoming budget should have been about addressing the fiscal deficit and expanding the tax net — but what we are getting is the same old tried and tested plans that have consistently failed.

Like previous budgets, the upcoming one lacks imagination. Increasing tax rates on the same sectors that have already been documented, implementing ambitious development programmes without considering how they might be funded, while not rationalising anything on the expenditure side of the sovereign. As the sovereign takes on additional debt, the State-Owned Entities continue to bleed the national exchequer or taxpayers’ money.

The budget is expansionary and inflationary in nature and is designed to be fueled by an ever-increasing quantity of debt at historically high-interest rates. Given recurring fiscal deficits, the state's failure or inability to expand its tax base will eventually result in higher inflation, making it even more difficult for households to survive or thrive.

The fastest-growing nation in terms of population will have less chance of prosperity or sustainable growth if its sovereign is fiscally irresponsible. The current and future generations will continue to pay for this fiscal profligacy, and refusal to chart out a sustainable growth trajectory for the economy, and its people.

The writer is an independent macroeconomist. He tweets @rogueonomist