Pakistan’s Rs14.46tr federal budget avoids new taxes in election year, envisages 3.5% growth

Govt proposes an allocation of Rs950 billion for development and increases the minimum wage to Rs32,000

June 09, 2023

Finance Minister Ishaq Dar Friday unboxed a Rs14.46 trillion budget for the fiscal year 2023-24, introducing "no new taxes" and envisaging an economic growth of 3.5% as the crisis-riven country looks to persuade the International Monetary Fund (IMF) to release more bailout money.

Pakistan has shared the budget numbers with the IMF, and the finance minister believes there are no further objections the lender could raise — as the country is in line with the programme requirements.

Dar — who presented the second budget of the Pakistan Democratic Movement-led government, which came into power in April last year, in the National Assembly and Senate — returned to the podium to announce the federal budget after a hiatus of five years.

At the outset of his budget speech — which began after a delay of almost two hours — the finance minister recalled that the country was "headed towards" economic prosperity during the Pakistan Muslim League-Nawaz's (PML-N) previous government.

But, he said, a "conspiracy" was hatched against then-prime minister Nawaz Sharif and the Pakistan Tehreek-e-Insaf (PTI) was "installed" as the country's ruling party.

Because of the PTI's "dismal governance" during its nearly four-year tenure, the finance minister said, the country was now facing one of the "worst economic crises".

FinMin Dar — who took charge of the finance ministry in September last year — mentioned that despite the economic challenges confronting Pakistan due to PTI's "misgovernance", the coalition parties still came into power.

"We took and are still taking tough decisions which have rescued the economy from default," he said — reiterating a statement that the incumbent rulers have stressed time and again.

Key takeaways

- No increase in duties on the import of essential items.

- Customs duties on raw materials of diapers, sanitary napkins exempted.

- Customs duty reduced from 10% to 5% on non-localised (CKD) heavy commercial vehicles (HCVs).

- Payments made through credit/debit cards to restaurants/resorts to be taxed at 5%.

- Filing of sales tax return for availing concessionary fixed tax rate of 0.25% for IT & ITeS exports not required anymore.

- Five-year tax holiday announced for agro-based industries being SMEs set up on or after July 1, 2023, from tax year 2024 to tax year 2028.

- Customs duties exempted on specific papers and art cards and board used for printing of Holy Quran.

- Incentive for exporters of IT and IT enabled services by allowing duty free import of IT related equipment equivalent to 1% value of their export proceeds.

- Withdrawal of capping of the fixed duties and taxes on the import of old and used vehicles of Asian Makes above 1,300cc.

- Sales tax on contraceptives and accessories exempted.

- The requirement of shop area for tier-1 retailers proposed to be withdrawn.

- 0.6% advance adjustable withholding tax on non-ATL persons on cash withdrawal re-imposition.

- Monetary limit of foreign remittance remitted from outside Pakistan increased from Rs5 million to (rupee equivalent of) $100,000.

- Waiver announced for 2% final withholding tax on purchase of immovable property for nonresident individual POC/NICOP holder where immovable property is acquired through foreign remittances remitted from abroad.

- Rationalisation of Super Tax under section 4C to apply on all persons across the board earning income above Rs150 million: insertion of additional three new income slabs of Rs350 million to Rs400 million, Rs400 million to Rs500 million and Rs500 million above to be taxed at 6%, 8% and 10% respectively.

The finance minister said that despite the numerous internal and external challenges faced by the country over the last year, the government upped its efforts and tried to provide relief to the people.

Dar mentioned that although the nation suffered massive losses of $30 billion due to unprecedented floods, the government is bidding to resume the IMF programme and take the country on the road of development.

"We have completed all the prerequisites of the ninth IMF review [...] we are hoping to reach an agreement with the IMF," the minister told the members of the lower house.

Current account deficit

He said that one of the major problems of the Pakistani economy is the current account deficit, adding that it had swelled to $17.5 billion during the fiscal year 2021-22.

However, the finance minister said, due to the "prudent decisions of the incumbent government" — majorly the import curbs — the CAD has been reduced by 77% to $4 billion.

Likewise, he said, the trade deficit has been reduced by $21 billion.

"The threat of default has been averted due to the tough decision of the government, and the fall in foreign exchange reserves has been slowed down," the finance minister said.

Increasing remittances

The finance minister said remittances are a crucial part of foreign exchange reserves, representing 90% of the country's exports.

In a bid to promote remittances through formal channels, the government has proposed the following steps:

- Abolishment of 2% final tax on the purchase of immovable property.

- Introduction of a "diamond card" for people sending over $50,000 — through which they can get one non-prohibited bore license, gratis passport, preferential access to Pakistani embassies and consulates, fast-track immigration at Pakistani airports, special prizes through draws.

Education

Highlighting the importance of education, the finance minister said that although the sector falls under provincial jurisdiction, the federal government always plays its part.

For the Higher Education Commission (HEC), the federal government has proposed an allocation of Rs65 billion under the current expenditure, while Rs70 billion have been allocated for development expenditure.

It was also revealed that Pakistan Endowment Fund would be established for the financial aid of the sector, for which Rs5 billion have been allocated in the budget.

Meanwhile, under the Prime Minister Laptop Scheme, the federal government has decided to distribute 100,000 laptops to merit-based deserving students, and for this, the cabinet has proposed to allocate Rs10 billion.

PSDP

The finance minister said the government had proposed an allocation of Rs1,150 billion (including Rs200 from Public Private Partnership mode), and for the provincial programme, Rs1,559 have been proposed.

Salient features of the proposed allocation of PSDP:

- 80% partially completed projects will be prioritised.

- 52% PSDP allocated for attracting foreign direct investment.

- For balanced growth among various cities, Rs108 billion have been allocated.

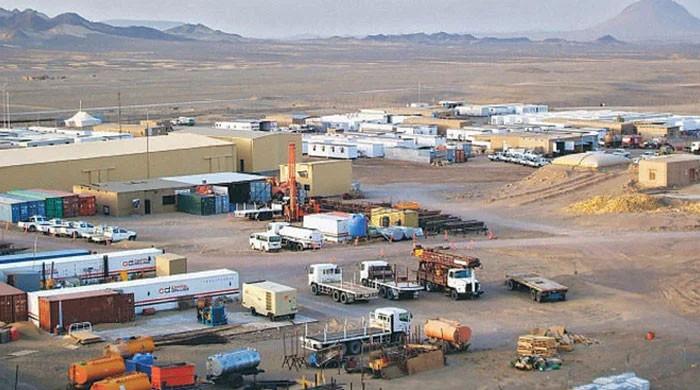

- The government has decided to pay special attention to the projects in Balochistan.

Construction

FinMin Dar further said that the construction sector is vital to the country's economic output.

"And in order to incentivise the construction sector", Dar said, "the 10% or Rs5 million, whatever amount is less, will be charged on construction enterprise income."

Those individuals who will construct their own property will be given a 10% tax credit or Rs5 million for the next three years as part of the concessions to the construction sector.

Real Estate Investment Trust (REIT)-related tax exemptions have been extended till June 30, 2024.

Energy needs

FinMin Dar said Pakistan depends on imported fuel to meet energy requirements, and the government is determined to promote solar energy and the use of local coal.

Several measures have been proposed to meet the country's energy needs:

- Coal-powered power plants have been instructed to use local coal.

- Raw materials of solar panels, inverters, and batteries are being exempted from customs duties.

- To resolve of issue of fuel shortage due to disruption in global fuel supply chain, “Bonder Bulk Storage Policy” is being introduced under which foreign suppliers using their own resources will import the fuel to store it in the fuel storage.

- Refinery and oil marketing companies will be allowed to buy oil from the storage facility.

FBR figures

The finance minister said Rs7,200 billion are likely to be collected in tax revenue — and the provinces' share would be Rs4,129 billion during the next fiscal year.

FBR is expecting to collect Rs1,618 billion from non-tax revenue, and federal tax collection will be Rs4,689, while total expenditure is estimated at Rs11,090 billion, he said.

‘No new tax this year’

Finance Minister Dar said no new tax is being imposed this year, and all efforts are being made to provide relief to the masses.

He said the government is trying to increase employment opportunities and introduce policies to promote ease of doing business.

Dar said industries and exporters should be encouraged to play their part in increasing the country's foreign exchange reserves.

FinMin Dar said imposing taxes on the rich is the leading principle of the government's taxation policy, and taxes were imposed on high-earning individuals.

Moreover, he added that the 10% super tax was imposed on 15 businesses and sectors earning up to Rs150 million in the last budget.

He said measures had been proposed to convert the super tax into progressive taxation by increasing its tax percentage.

The Dar-led Ministry of Finance has proposed the imposition of a 10% withholding tax on the bonus shares (in-kind dividend) as the finance minister said that some companies, in order to skip taxes, issue bonus shares instead of cash dividends.

Foreign currency outflow

The finance minister said not only was there a need to increase the foreign exchange reserves of the country, but loopholes dwindling the reserves needed to be eliminated as well.

In this regard, he said, withholding tax has been increased from 1% to 5% for tax filers, while non-filers will pay a 10% withholding tax on international transactions to discourage the outflow of foreign currency through debit and credit cards and other banking channels.

Pensions, wages

In his speech, the finance minister said the government is aware of the difficulties faced by government employees, and keeping this in mind, several steps are being taken for their relief.

He said it had been proposed to increase the minimum wage to Rs32,000 for Islamabad Capital Territories (ICT).

Dar said that the minimum pension is being increased to Rs12,000. He also proposed to increase the Employees' Old-Age Benefits Institution (EOBI) pension to Rs10,000.

It has also been proposed that the government will pay debts up to Rs1 million of widows through the House Building Finance Corporation (HBFC), while the deposit limit in national savings accounts for martyrs has been increased from Rs5 million to Rs7.5 million.

The finance minister said that the Behbood Savings Certificate deposit has been proposed to increase to Rs7.5 million from Rs5 million.