Finance Act 2023 comes into effect

Government imposes 6% super tax on individuals earning between Rs350 million and Rs400 million annually

July 01, 2023

With extending the lower income limit for imposing a 10% super tax, the federal government has started implementing the Finance Act 2023 from today (Saturday).

As per the Finance Act shared by the Federal Board of Revenue (FBR) on its website, 10% of the income tax will be applicable where income exceeds Rs500 million.

With a focus on “economic stability”, the federal government has introduced three more slabs for the wealthy people paying super tax in the Finance Bill 2022-23.

The government imposed a 6% super tax on individuals earning between Rs350 million and Rs400 million annually. Under the bill, 8% of the income tax will be charged to those between Rs400 million and Rs500 million.

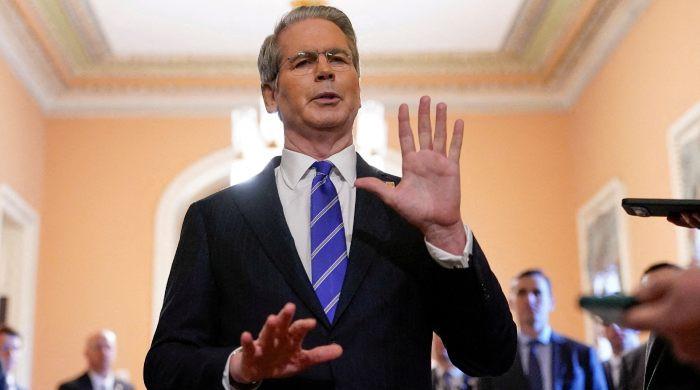

Dar unveiled Rs14.46 trillion budget

On June 9, Finance Minister Ishaq Dar unboxed a Rs14.46 trillion budget for the fiscal year 2023-24, introducing "no new taxes" and envisaging an economic growth of 3.5% as the crisis-riven country looks to persuade the International Monetary Fund (IMF) to release more bailout money.

Pakistan has shared the budget numbers with the IMF, and the finance minister believes there are no further objections the lender could raise — as the country is in line with the programme requirements.

Dar — who presented the second budget of the Pakistan Democratic Movement-led government, which came into power in April last year, in the National Assembly and Senate — returned to the podium to announce the federal budget after a hiatus of five years.

Key takeaways of budget

- No increase in duties on the import of essential items.

- Customs duties on raw materials of diapers, sanitary napkins exempted.

- Payments made through credit/debit cards to restaurants/resorts to be taxed at 5%.

- Filing of sales tax return for availing concessionary fixed tax rate of 0.25% for IT & ITeS exports not required anymore.

- Five-year tax holiday announced for agro-based industries being SMEs set up on or after July 1, 2023, from tax year 2024 to tax year 2028.

- Customs duties exempted on specific papers and art cards and board used for printing of Holy Quran.

- Incentive for exporters of IT and IT enabled services by allowing duty free import of IT related equipment equivalent to 1% value of their export proceeds.

- Withdrawal of capping of the fixed duties and taxes on the import of old and used vehicles of Asian Makes above 1,300cc.

- Sales tax on contraceptives and accessories exempted.

- The requirement of shop area for tier-1 retailers proposed to be withdrawn.

- 0.6% advance adjustable withholding tax on non-ATL persons on cash withdrawal re-imposition.

- Monetary limit of foreign remittance remitted from outside Pakistan increased from Rs5 million to (rupee equivalent of) $100,000.

- Waiver announced for 2% final withholding tax on purchase of immovable property for nonresident individual POC/NICOP holder where immovable property is acquired through foreign remittances remitted from abroad.

- Rationalisation of Super Tax under section 4C to apply on all persons across the board earning income above Rs150 million: insertion of additional three new income slabs of Rs350 million to Rs400 million, Rs400 million to Rs500 million and Rs500 million above to be taxed at 6%, 8% and 10% respectively.

Rs215bn new taxes

The government has agreed to impose Rs215 billion in new taxes as part of its last-ditch efforts to revive the stalled International Monetary Fund (IMF) loan programme, the finance minister told the National Assembly on June 24.

The development came a day after Prime Minister Shehbaz Sharif met IMF Managing Director Kristalina Georgieva in Paris, on the sidelines of the Global Financing Summit.

Addressing the lower house of parliament, the financial czar said: "Pakistan and the IMF had detailed talks as a last effort to complete the pending review."

During the negotiation, the government has agreed to introduce a number of changes to its budget for the fiscal year 2024, he added.

Dar said that they would collect a further Rs215 billion in new tax and cut Rs85 billion in spending. He added that they would take a number of steps to shrink the budget for the fiscal year starting from July.

Giving further details, the federal minister said: “Pakistan has agreed on Rs215 billion taxes after three-day parleys with the officials of the IMF to complete the 9th review under the EFF, pending due to the country’s external financing gap.”

“As a result of the talks with the IMF, for the fiscal year 2023-24, the final taxes of only Rs215 have been agreed, ensuring that it will not burden the poor and middle segments of the society,” he said while winding up general discussion on the budget for the year 2023-24.

Pakistan, he further said, would bring down the running expenditure by Rs 85 billion, which would have no impact on the proposed development budget, the raise in salaries and pensions of the federal government employees.

He said the government held talks with the Washington-based lender with complete sincerity and assured the parliament that once the things with the international lender were settled; all details would be made public by placing the agreement on the official website of the Ministry of Finance.

Resultantly, he said the proposed tax collection target of the Federal Board of Revenue (FBR) had been increased from Rs9.2 trillion to Rs9.415tr, with the provincial share going up from Rs5.276tr to Rs5.390tr, the federal government total expenditure estimate from Rs14.460tr to Rs14.480tr and pension estimate from Rs761 billion to Rs801bn.

Similarly, he said the subsidy estimate would be at Rs1.064tr and grants at Rs1.405tr, adding as a result of all these measures, the overall budget deficit would come down with a cushion of Rs300bn [Rs215 billion taxes and Rs85 billion reduction in running expenditures].