Fact-check: Sindh agriculture department doesn’t collect income tax?

Sindh’s agriculture department does not have an income tax section, but that is because the Board of Revenue has the mandate to collect agriculture taxes

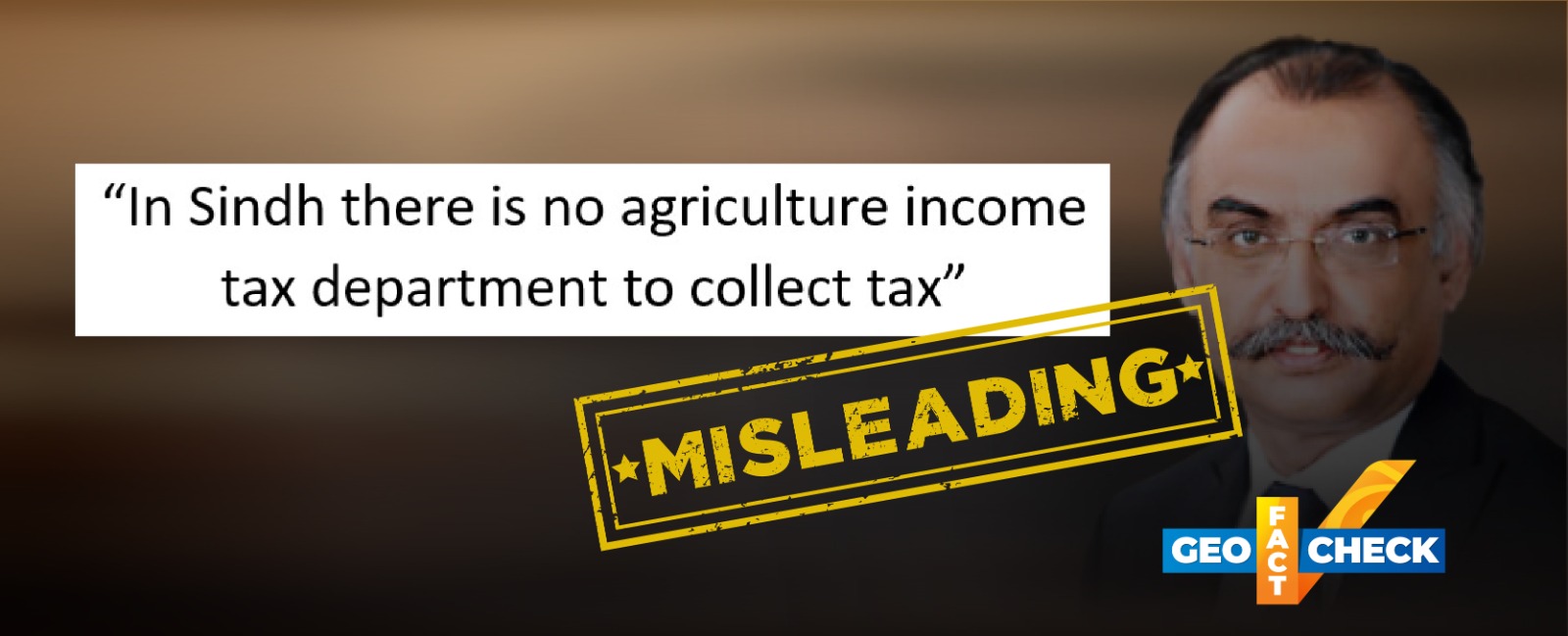

Shabbar Zaidi, the former chairman of Pakistan’s Federal Board of Revenue (FBR), has claimed that even though the Sindh province has an agriculture department, it is not empowered to collect taxes on income from farmers.

Zaidi’s statement is true, but it omits important context.

Claim

On July 28, Shabbar Zaidi, the former chairman of the Federal Board of Revenue, a state agency that administers and enforces tax laws, said during a televised interview that there were several reasons for the low contribution of agriculture to the government's tax revenue.

One of which, he added, was that there was no income tax collection wing in Sindh’s agriculture department.

“I have been Sindh’s caretaker finance minister in the past and I will say this on the record,” Zaidi said, “Today, in Sindh there is no agricultural income tax department and then you are asking me why agriculture income taxes are not being recovered.”

The video has been viewed over 148,000 times.

Fact

It is true. Sindh’s Agriculture, Supply and Prices Department does not have an income tax section, confirm officials. However, that is because another department, the Board of Revenue (BOR), has been tasked by the law to collect land and agricultural taxes in the province.

In fact, none of the provincial agricultural departments in Pakistan have a dedicated income tax section.

Aijaz Ahmed Mahesar, the secretary at the Agriculture, Supply and Prices Department, told Geo Fact Check over the phone that the BOR is the “sole land revenue collection entity” in the province.

“The Agriculture Department is not the right department to collect taxes,” he added.

Geo Fact Check then reached out to Muhammad Sohail Rajput, the chief secretary of Sindh, who also confirmed the same on August 11. (Rajput has since been transferred to another designation).

“The system for collection of all the revenues from land through the Board of Revenue has been in place since before independence,” Rajput replied via messages, “It is the same in all the four provinces.”

Furthermore, Zahid F Ebrahim, a Karachi-based lawyer, explained to Geo Fact Check that the provincial law, the Sindh Land Tax and Agricultural Income Tax Act, empowers the Board of Revenue to collect agricultural taxes.

Follow us on @GeoFactCheck. If our readers detect any errors, we encourage them to contact us at [email protected].