Workers’ remittances increase by 11.5% in October

SBP says in the first four months of the ongoing fiscal year the inward remittances stood at $8.8 billion

November 10, 2023

- SBP says inward remittances stood at $8.8 billion from Jul-Oct.

- Remittances increased by 9.6% on YoY basis.

- Analyst credits crackdown against hundi/hawala for increase.

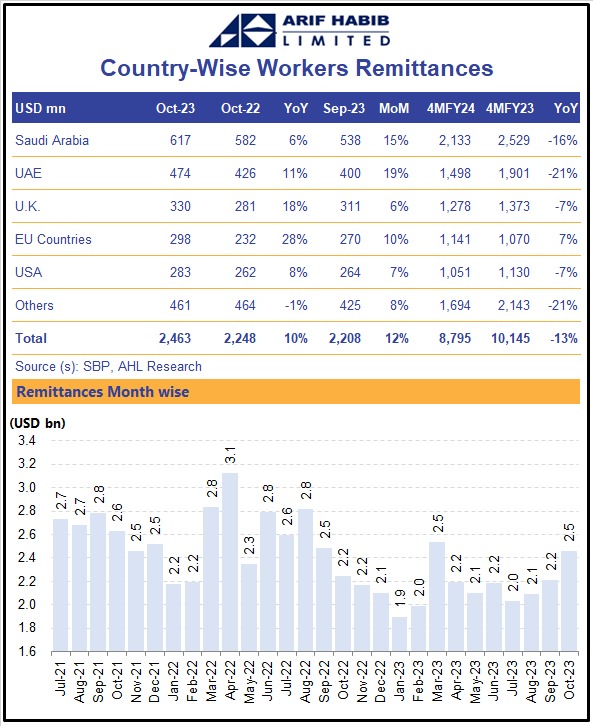

KARACHI: The remittances from the overseas workers were recorded at $2.5 billion in the month of October making it an increase of 11.5% month-on-month basis, said the State Bank of Pakistan (SBP) in a statement on Friday.

“In terms of growth, during October 2023, remittances increased by 11.5% on month on month and 9.6% on year on year basis,” said the central bank.

The central bank also shared that in the first four months of the ongoing fiscal year, the inward remittances stood at $8.8 billion.

As per the SBP, out of the $2.5 billion, Pakistani workers from Saudi Arabia sent $616.8 million, United Arab Emirates was second with $473.9 million, remittances from United Kingdom were recorded at $330.2 million and $283.3 million was sent from the United States.

Former economic adviser to the Ministry of Finance Dr Khaqan Najeeb credited the closing of the exchange rate between the open and interbank markets and curbing of illegal exchange for the increase in remittances.

“Closing of the exchange rate between the open market and interbank has helped remittances flow through the formal sector increasing the October remittances by nearly $300 million compared to last month,” said Dr Najeeb.

The economist states that the recent “enforcement measures” undertaken by the government against the illegal exchange market had helped bring down the demand for smuggling for dollarisation and also control hundi/hawala.

“This has all helped channelise remittances through the interbank,” said Dr Najeeb. He added that the increase in remittances from the Middle East was an indicator that hundi/hawala was declining as these countries have a higher percentage of the hundi/hawala business.

“This overall is contributing to the improvement in the remittances in October,” said the economist.