'We have not lost our pride': Govt clears the air on PIA's privatisation

PM's aide says state expects new PIA owner to take charge by April 2026, subject to approvals

December 24, 2025

- Ali rejects claims that airline sold below aircraft value.

- Says govt to receive 7.5% in cash, 25% in equity value.

- Rs125bn to be reinvested in airline: PM's privatisation aide.

ISLAMABAD: Rejecting criticism over the privatisation of Pakistan International Airlines (PIA), Prime Minister's Adviser on Privatisation Muhammad Ali on Tuesday said that the move does not undermine national pride but aims to restore the carrier’s lost strength and efficiency.

Addressing a joint press conference with Federal Information Minister Atta Tarar, Muhammad Ali said that claims circulating on social media suggesting that the airline was sold for less than the value of its aircraft were incorrect and misleading, adding that such assertions do not reflect the facts of the privatisation process.

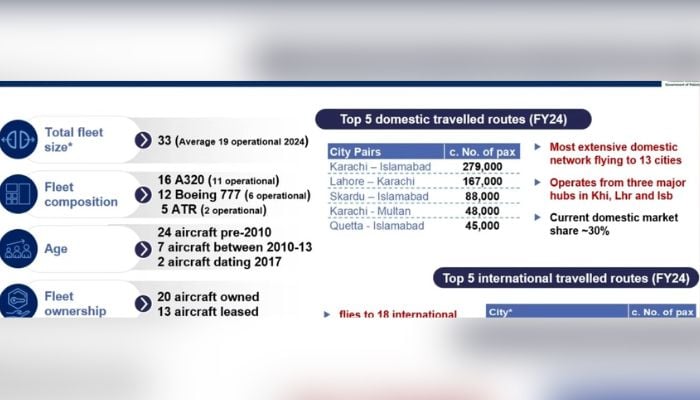

He said that PIA once operated a fleet of around 50 aircraft, but currently only 17 to 19 planes are operational, while 12 aircraft are on lease.

The remarks came a day after a consortium led by Arif Habib Corporation emerged as the top bidder for a 75% stake in the national carrier, offering Rs135 billion in what authorities hailed as a landmark moment.

Ali said PIA facilitates travel for around four million passengers annually, describing its landing and route rights as its most valuable assets.

He added that PIA was once a strong and reputable airline, and expressed confidence that privatisation would gradually help restore its lost stature and operational strength.

The adviser also addressed the claims that the government would only get Rs10 billion from the PIA’s privatisation, stating that the government would get 7.5% in cash and 25% in equity’s value — amounting to Rs10 billion and 45 billion, respectively.

He said the government would receive a total of Rs55 billion from the bidding proceeds, while Rs125 billion would be reinvested in PIA.

"PIA privatisation has been successfully completed, and the entire nation witnessed the transparent process."

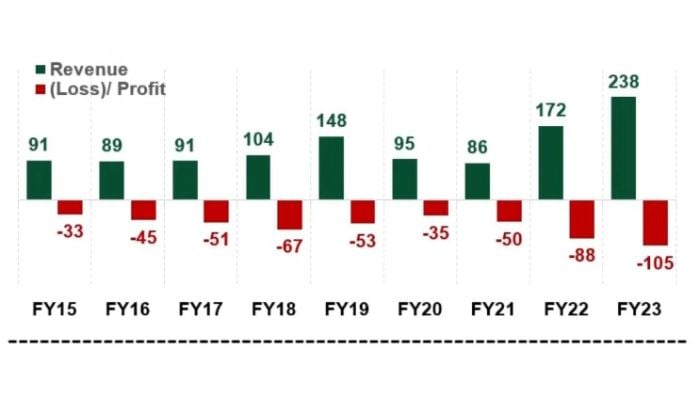

On the airline’s financial decline, the adviser said PIA's performance deteriorated significantly after 2009. He revealed that the national carrier incurred losses of Rs500 billion over the past 10 years.

Separately, Ali told Reuters in an online interview that the state expects a new owner to be running the airline by April, subject to approvals.

The process now moves to final approvals by the Privatisation Commission board and the cabinet, expected within days, with contract signing likely within two weeks and financial close after a 90-day period to meet regulatory and legal conditions.

The deal was structured to inject fresh capital into the airline rather than simply transfer ownership, he said. "We did not want a situation where the government sells the airline, takes its money, and the company still collapses," Ali said.

Moreover, the Privatisation Commission Board (PC Board), in its 246th meeting held today under the chairmanship of PM’s aide Ali, recommended the bid offer submitted by the Arif Habib Consortium for consideration and approval by the Cabinet Committee on Privatisation.

The Board noted with satisfaction the bid amount of Rs. 135 billion, received against the reference price of Rs. 100 billion, for a 75% stake of PIA.

The Board also acknowledged the efforts of all stakeholders involved in the transaction, including the Financial Adviser and the Privatisation Commission’s transaction team.

The Board further commended the leadership of the Adviser to the Prime Minister on Privatisation in steering the transaction to its final stage.

PIA auction

The auction held on Tuesday marked Pakistan's first major privatisation in nearly two decades and comes amid pressure to reform loss-making state firms under a $7 billion International Monetary Fund (IMF) programme.

Arif Habib and Lucky Cement consortia advanced to the open auction stage after placing offers above the reference price of Rs100 billion, while private airliner Airblue exited the bidding after submitting an offer of Rs26.5 billion.

In the first round of the open auction, Lucky Cement Limited–led consortium increased its earlier bid of Rs101.5 billion to Rs115.5 billion. The round concluded with Arif Habib increasing its bid to Rs121 billion, while Lucky Cement closed the session with an offer of Rs120.25 billion.

The organisers then announced a 30-minute recess at the request of Lucky Cement.

Latter, Lucky Cement increased its bid to Rs134bn, immediately followed by a counteroffer of Rs135bn from Arif Habib.