SBP eases rules for exporters to use foreign currency accounts

This action was taken to facilitate exporters, encourage ease of doing business, and further liberalise use of retained money

February 25, 2024

- Exporters allowed to use funds without prior approval.

- This step is to facilitate trade and ease of doing business.

- Pakistan’s total exports rose to $2.792 billion in January.

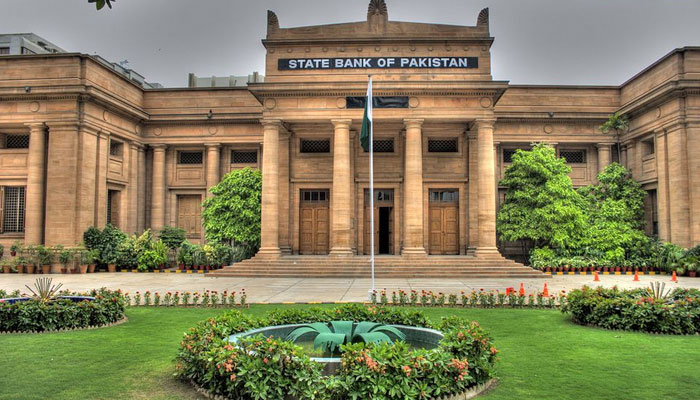

KARACHI The State Bank of Pakistan (SBP) said it had allowed exporters to use funds in their special foreign currency accounts for any kind of payments abroad without prior approval, in a move to facilitate trade and ease of doing business.

“Authorised dealers (ADs) may allow exporters of goods and services to retain a prescribed percentage of their export proceeds in Exporters’ Special Foreign Currency Account (ESFCAs),” the SBP said in a circular.

“In this regard, the exporters may utilise these funds freely for making all types of payments abroad of current account nature to fulfil the needs of their own businesses, without prior SBP approval.”

This action was taken by the central bank to facilitate exporters, encourage ease of doing business, and further liberalise the use of retained money.

“The authorised dealers are required to facilitate the exporters (on specific request) by issuing debit cards against balances held in ESFCAs. However, no cash withdrawal in foreign currency from ESFCAs shall be allowed within Pakistan,” said the SBP.

As per the guidelines of the SBP, exporters may pay for imports for their business purposes as long as they comply with the relevant laws and regulations and the applicable import policy order.

“The funds in ESFCAs can also be used for making payments with regard to capital and financial account transactions, such as equity investment abroad and foreign currency loan repayments. However, in case of remittance of such transactions, the proper procedure as described in the relevant regulations shall be followed,” it said.

The exports have shown a recovery in recent months after being hit by high energy costs and a shortage of dollars for importing raw materials.

Pakistan’s total exports rose to $2.792 billion in January, up 24% from a year earlier. Exports increased by 7.87% to $17.778 billion in the seven months of fiscal year 2023-24.

The country’s textile exports increased by 10% year-on-year to $1.45 billion in January. The export of value-added textile products rose to $1.04 billion in January, up 12% from the same month last year. Similarly, basic textiles and other textiles also witnessed an increase of 6% and 3% to stand at $0.24 billion and $0.16 billion, respectively, in January.

Pakistan's monthly exports of information technology were $265 million, up 39% year-on-year but down 13% month-on-month in January. January's IT exports exceeded the $227 million 12-month average. IT exports increased by 13% to $1.5 billion in July-January FY24.

The rise in IT exports, according to analysts, is the result of two factors: a stable local currency, which encouraged IT companies to repatriate their foreign income and deposit it in local accounts, and the SBP's relaxation of the permissible retention limit, which increased it from 35 to 50% in exporters' special foreign currency accounts.

Originally published in The News