Pakistan faces tax evasion of Rs5.8tr annually

Highest tax evasion existed in sales tax which could go up to Rs2.9 trillion on annual basis

March 25, 2024

- Tax evasion on POL products estimated to be Rs996bn.

- Highest tax evasion exists in sales tax at around Rs2.9tr.

- Tax compliance could add 5.8% to national exchequer.

ISLAMABAD: Pakistan's tax evasion (revenue gap) was estimated to be around Rs5.8 trillion on an annual basis of fiscal year 2022-2023, which makes 6.9% of the GDP, The News reported.

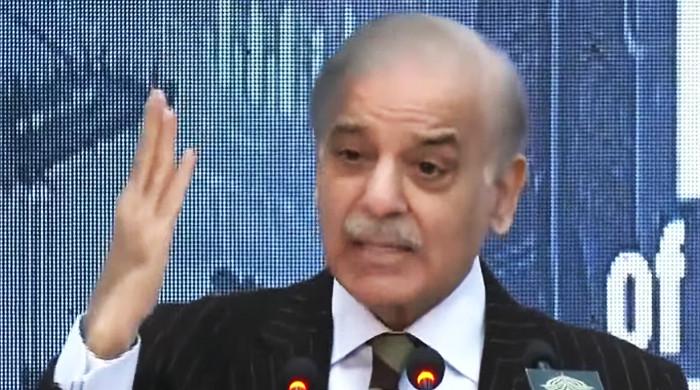

This was revealed to Prime Minister Shehbaz Sharif and Special Investment Facilitation Council (SIFC) during a presentation, according to which, the evasion on petroleum products is estimated to be Rs996 billion due to smuggling and other means.

Meanwhile, the evasion in the retail sector of the country stood at Rs888 billion, transport sector Rs562 billion, independent power producers (IPPs) Rs498 billion, smuggled-prone items Rs355 billion, exports Rs342 billion and real estate Rs148 billion on annual basis.

The tax evasion in "others" category was estimated at Rs1.607 trillion annually.

The presentation revealed that highest tax evasion existed in sales tax which could go up to Rs2.9 trillion on annual basis. Moreover, the gap in customs stood at around Rs0.6 trillion (Rs600 billion) annually including under-invoicing and smuggling.

The International Monetary Fund (IMF), in its diagnostic report, has analysed that the policy level tax gap was not on the much higher side and it could go up to a maximum of 12.9% of the GDP.

There was also a compliance gap between the total revenues and expenditures, with federal tax revenues standing at 9.1% of GDP while the federal non-tax revenue was at 1.2% of GDP.

The presentation also stated that provincial taxes contributed to around 1% in the GDP while the total revenues stood at 11.4% of GDP.

Meanwhile, the federal expenditure to the GDP stood at 12.9% and provincial expenditure around 6.1%, so the total expenditure jacked up to 19% of the GDP. There is a gap of 7.6% of GDP between the total revenues and expenditures of the country.

As per the presentation, the tax compliance alone could add 5.8% of the GDP to national exchequer annually.

This tax-evasion, also called fiscal gap or fiscal deficit, is financed through borrowing from the domestic and external avenues, thus, plunging the country into a debt trap, an independent economist told The News.

The government is also considering to restructure the Federal Board of Revenue (FBR) through the Federal Policy Board, separation of Tax Policy Office, joint valuations, separation of Customs and Inland Revenues, collaboration with Nadra, PRAL restructuring, digital invoicing, SWAPS, Tajir Dost Retailers Scheme, documentation law and modern governance structure and oversight boards.