Buffett divests stake in General Electric

Berkshire had previously held 10.4 million shares in the US industrial giant

August 15, 2017

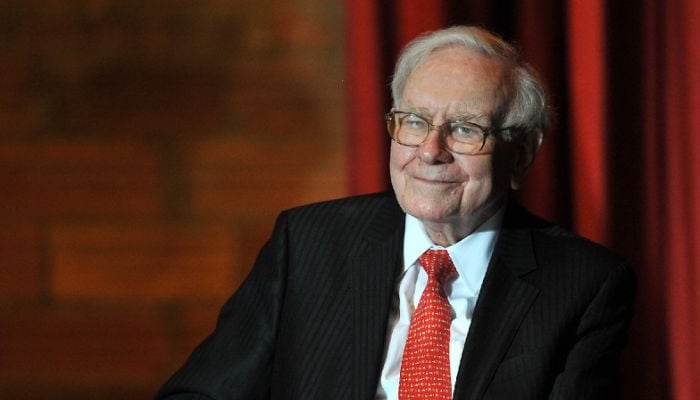

NEW YORK: Warren Buffett's Berkshire Hathaway has sold off its stake in General Electric, according to US regulatory papers filed Monday.

Berkshire had previously held 10.4 million shares in the US industrial giant, according to earlier securities filings.

But GE was no longer listed among the 20 or so Berkshire stakes, according to the company's filing with the Securities and Exchange Commission.

Shares of General Electric are down nearly 20 percent thus far in 2017, a stark underperformance compared with the index, which has risen more than 11 percent.

GE has been hurt by weakness in its oil and gas business.

The company in June announced that longtime chief executive Jeff Immelt was retiring and would be replaced by GE veteran John Flannery. But a disappointing outlook during the company's July earnings conference call further pressured shares.

As Berkshire Hathaway exited GE, it added a 17.5 million share stake in Synchrony Financial, a credit card company spun out of GE in 2015.

Shares in GE dipped 0.4 percent in after-hours trading to $25.27, while Synchrony rose 4.4 percent to $30.95.