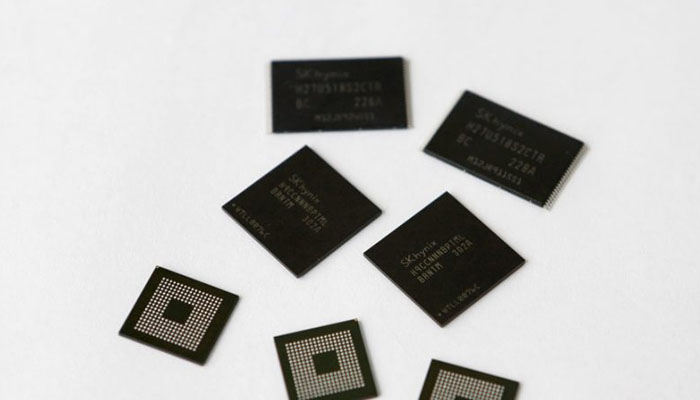

Memory boost: How chipmakers are weathering slowing smartphone sales

Smartphone makers are cramming devices with memory to satisfy increasing demands of consumers

May 08, 2018

SEOUL/SINGAPORE: Investors in global chipmakers have had a rocky ride in the last few months on worries about a slowing smartphone market, but a clamor for more video content from consumers is underpinning buoyant sales for memory-chip makers.

Indeed, the earnings reports of various chipmakers and smartphone companies in the past month tell a more interesting story beyond the cooling in phone shipment volumes: smartphone makers are cramming their devices with memory to satisfy the increasing demands of consumers.

A case in point is last week’s quarterly report from Apple Inc. The Cupertino, California-based company said the iPhone X was the most popular iPhone model in the March quarter - the first cycle ever where the costliest iPhone was also the most sought after.

More upbeat assessments from Samsung Electronics Co Ltd, Qualcomm Inc, and Franco-Italian company STMicroelectronics, have also eased concerns.

Samsung last month forecast strong sales for “high-density” chips that have more processing power and bigger storage capacity - demand that will help it weather a decline in overall smartphone shipments as consumers are willing to pay for costlier and faster models that allow them to easily watch and store large amounts of video.

“Even as the number of smartphone shipments slows down, each smartphone will contain memory chips with bigger capacity and better performance, which, for memory chip makers, makes up for a slowdown in the number of total smartphones,” said Kim Rok-ho, an analyst at Hana Financial Investment.

That puts into perspective a warning by Taiwan Semiconductor Manufacturing Co Ltd of softer smartphone sales, which was partly responsible for the recent selloff in Apple and other chipmakers.

The broader concerns about a slowdown in the chip market appear to have eased as well.

The Philadelphia Semiconductor Index .SOX, a proxy for global chipmakers that fell sharply from its peak in mid-March on initial iPhone sales concerns, has stabilized in the past two weeks, posting a 4.4 percent rise so far this year.