'Mitigating risk': SBP denies declaring virtual assets illegal

Central bank says 2018 advisory cautioned regulated entities from dealing in VAs due to lack of legal framework

May 30, 2025

ISLAMABAD: The State Bank of Pakistan (SBP) has issued a clarification about cryptocurrencies "deemed illegal" in Pakistan, saying that its 2018 advisory did not declare virtual assets (VAs) illegal, but only cautioned its regulated entities from dealing in them due to the "lack of a legal and regulatory framework".

In its press release, the central bank said its advisory asked banks, development finance institutions (DFIs), microfinance institutions, electronic money institutions (EMIs), and other financial service providers to safeguard consumers and the financial system from potential risks associated with unregulated digital assets.

"The advisory was issued solely to protect our regulated entities and their customers, not because VAs were declared illegal,” the SBP said.

The clarification comes following a briefing to the National Assembly's Standing Committee on Finance, where it was suggested that the trading and holding of cryptocurrencies remain illegal in Pakistan.

SBP Executive Director Sohail Jawad had testified that the 2018 directive was still in effect and that entities must report crypto-related cases to the Financial Monitoring Unit (FMU) for further investigation by the FIA.

However, the SBP clarified that it is currently engaged, along with the Finance Division, with the Pakistan Crypto Council (PCC), which was recently established by the federal government to help design a regulatory and legal framework for cryptocurrencies in Pakistan.

The SBP added that a formal framework would bring clarity to the legal status of VAs in the country while ensuring investor protection and consumer safeguards.

'Crypto still illegal in Pakistan'

During the briefing to Standing Committee on Finance, Secretary Finance Imdad Ullah Bosal said that cryptocurrencies are still illegal and banned in Pakistan.

All those involved in dealing with cryptocurrency could be investigated by the Financial Monitoring Unit (FMU) and the Federal Investigation Agency (FIA), the NA body was told.

Although the secretary finance conceded before the committee that there was no legal parliamentary backing for digital cryptocurrency, the Pakistan Crypto Council (PCC) was established under the chairmanship of Finance Minister Muhammad Aurangzeb, but it was just a task force for recommending a legal and procedural framework to move ahead.

Committee Chairman, Nafisa Shah, wondered how the crypto council was established without consulting the parliament and the SBP. To which, the secretary finance said it was constituted by Prime Minister Shehbaz Sharif through executive orders.

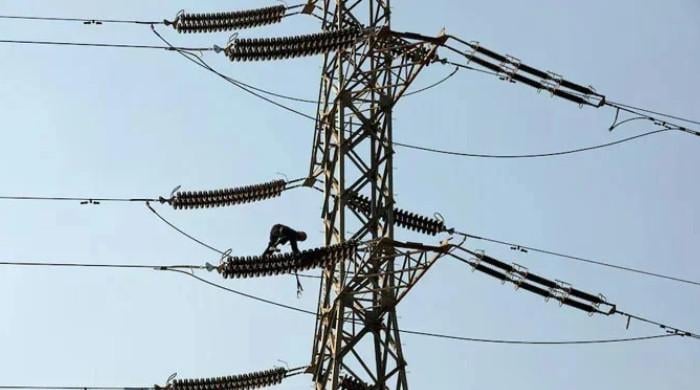

Mirza Ikhtiyar Baig asked why the government does not provide 2,000MW electricity to the local industry instead of mining crypto currencies through it.

The secretary of finance suggested that the committee convene the PCC high-ups, SBP and SECP in the next meeting and get a detailed briefing on this subject.

Earlier this month, the federal government announced allocating 2,000 megawatts (MW) of electricity in the initial phase of a national plan to support Bitcoin mining and artificial intelligence (AI) data centres.

Pakistan, a country that ranked 3rd in the Global Crypto Adoption Index, has 20 million active cryptocurrency users and $20bn+ in crypto transactions.

Currently, the country ranks in the top 10 in terms of crypto adoption. With $35bn in annual remittances, the country is poised to benefit from crypto adoption.