Rs40,000 prize bonds worth Rs152 billion encashed

National Savings expecting Rs194 billion to be withdrawn by investors by end of September

September 22, 2019

ISLAMABAD: Directorate of National Savings (CDNS) has pointed out that the investors of Rs40,000 prize bonds have withdrawn Rs 152 billion by August 31, out of total stock of Rs259 billion investment from CDNS after the federal government decided to discontinue the specific bond.

The National Savings is expecting that total amount to be drawn by the investors, would be around Rs194 billion by end of September, out of which Rs40 billion were drawn in July and Rs112 billion in August, a senior official of CDNS told APP.

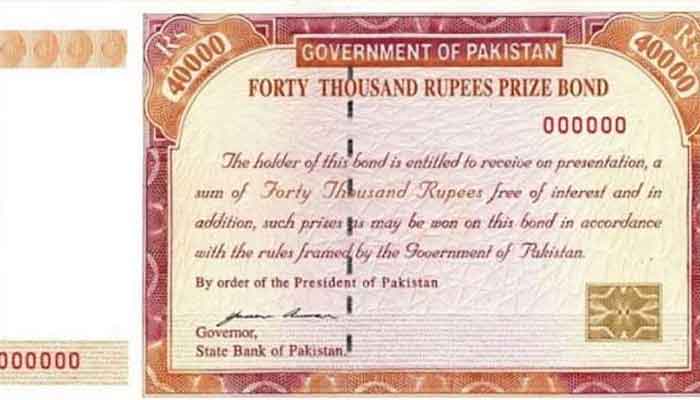

The government froze the prize bond of Rs40,000 a few months ago when the State Bank of Pakistan (SBP) issued circular and directed all commercial banks to stop selling Rs40,000 prize bonds from June 24 onwards.

According to a notification, SBP directed that national prize bonds worth Rs40,000 denominations should not be sold after June 24 and would not be encashed or redeemed after March 31, 2020.

Responding to a question he said CDNS has decided not to change the rates of different certificates for September 2019 to promote the culture of savings in the country.

The CDNS has already increased rates on various savings certificates aimed at persuading the customers to invest with CDNS.

"In previous board meeting the CDNS notified the upward revision in the profit rates for various saving certificates with effect from July 1st (2019), encouraging people to invest in various schemes of the Directorate," he said.

The official was of the view that the upward revision of these certificates would generate more revenues that could be utilised as budgetary support by the government to overcome budget deficit problems.

He said the new rate for Defense Savings Certificate has been increased from 12.47 per cent to 13.01 per cent while the rate of Special Saving Certificate from 11.57 to 12.90, Regular Income Certificate from 12 per cent to 12.96 per cent.

Likewise, the rates of Savings Accounts have been increased from 8.5 per cent to 10.25 per cent while the rates of Bahbood Savings Certificates and Pensioners' Benefit Account were increased from 14.28 per cent to 14.76 per cent.

The official added the government had also increased the short-term (three months), medium-term (six months) and long-term (12months) certificates to attract more people towards savings and investments with CDNS.

He said the new rates for short-term certificates have been increased from 9.8 per cent to 12.08 per cent, medium-term from 9.88 per cent to 12.18 per cent while the rate of a long-term certificate has been enhanced from 9.98 per cent to 12.28 per cent.

The official further said the CDNS has set Rs 350 billion annual net targets for the year 2019-20 as compared to Rs324 billion for the previous year's 2018-19 to enhance savings and promoting saving culture in the country, the official said.

The Directorate has also revised and increased the gross target of Rs 1570 billion for the fiscal year 2019-20, he added.

He informed that CDNS had collected Rs410 billion by June 30, exceeding the target of Rs324 billion set for the year while during the preceding year of 2017-18, CDNS collected Rs155 billion.

The total savings held by the CDNS stood at Rs1,150 billion by June 30, while the directorate had Rs774 billion savings by the same date, a year ago, he added.