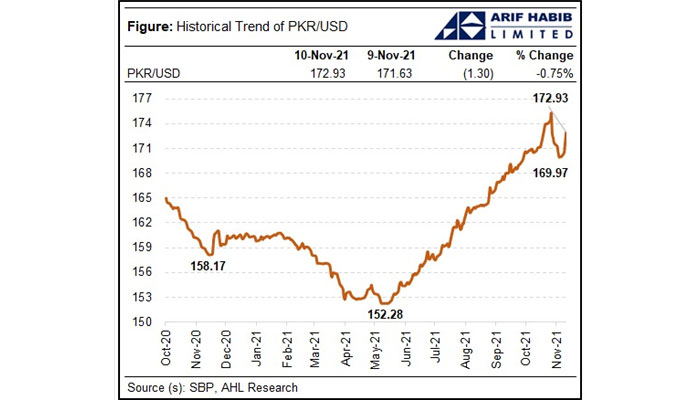

Rupee weakens by Rs1.3 against US dollar

Depreciating by 0.75%, the local currency closed the day's trade near a two-week low of Rs172.93 per US dollar

November 10, 2021

- Depreciating by 0.75%, the local currency closed the day's trade near a two-week low of Rs172.93 per US dollar.

- Cumulatively, the local currency has lost around 1.71% during last five days.

- Investors turned wary of the delay in IMF programme, evaluated economic risks in case country failed to meet fund’s conditions.

KARACHI: The rupee continued to lose its ground against the US dollar during the third consecutive session in the interbank market on Wednesday, depreciating by Rs1.3 to close the day's trade near a two-week low of Rs172.93 per US dollar.

Cumulatively, the local currency has lost around 1.71% during last five days.

Investors turned wary of the delay in International Monetary Fund’s (IMF) programme and evaluated economic risks in case the country failed to meet the fund’s conditions.

Analysts said that dollar demand from importers remained consistently high for settling payments in recent sessions, amidst fears that the next tranche of $1 billion might get delayed due to Islamabad’s indecision on meeting the IMF’s strict conditions for the completion of the sixth review.

This fear has prevented the rupee from gaining, though the Real Effective Exchange Rate (REER) has shown the local currency as undervalued, they added.

The rupee has maintained the downtrend for the past five months. It has lost 13.56% (or Rs22.66) to date, compared to the 22-month high of Rs152.27 recorded in May.

With a fresh decline of 0.75%, the rupee has depreciated 9.76% (or Rs15.39) since the start of the current fiscal year on July 1, 2021, data released by the central bank revealed.

On Tuesday, speaking to Geo.tv, Arif Habib Limited's (AHL) Head of Research Tahir Abbas had said that the government needs to take immediate action because the uncertainty has started prevailing in the market.

“Whenever there is uncertainty in the market significant fluctuations are observed in the local currency,” the analyst had said.

Abbas added that depreciation in rupee also creates inflationary pressure which is bad for the economy as surging inflation means that the import bill will widen increasing the demand for the dollar.

“As soon as clarity regarding IMF is received the marker will reverse its trend,” he had predicted.