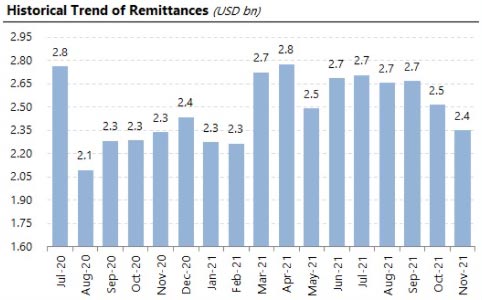

Remittances slow down to $2.4bn in November

November is 18th successive month in which receipts remained above threshold of $2bn, central bank reports

December 13, 2021

- November is the 18th successive month in which receipts remained above $2bn.

- Remittances fall 6.6% to $2.4 billion in November on a month-on-month basis.

- Cumulatively, in the first five months of FY22, remittances clocked in at $12.9bn.

KARACHI: The inflow of workers’ remittances into Pakistan increased by 0.6% to $2.35 billion in November, compared to $2.33 billion in the same month of the previous year.

November was the 18th successive month in which receipts remained above the threshold of $2 billion, the State Bank of Pakistan (SBP) reported on Monday.

According to data released by the central bank, the remittances sent home by overseas Pakistanis fell 6.6% to $2.4 billion in November on a month-on-month basis.

Cumulatively, in the first five months (July-November) of the current fiscal year, remittances clocked in at $12.9 billion with an increase of 9.7% compared to $11.76 billion received in FY21.

Speaking to Geo.tv, a financial analyst said that the remittances slowed down as international travel resumed.

“With ease in travel restrictions, some non-resident Pakistanis have once again started sending money through illegal channels of hundi-hawala operators,” he said.

Moreover, a month-on-month decrease can also be attributable to the fresh concerns of the new COVID-19 variant Omicron.

“Proactive policy measures by the government and SBP to incentivise the use of formal channels and altruistic transfers to Pakistan amid the pandemic have contributed towards the sustained inflows of remittances since last year,” the central bank said.

Country-wise remittances

Country-wise data reveals that inflows from the United States of America (USA) increased by 30.4% to $237.8 million in November compared to the same month of last year. They improved 14.1% to $305.8 million from the United Kingdom (UK).

Inflows slightly rose by 0.4% to $452.5 million from the United Arab Emirates (UAE) while remittances fell 1.8% to $590 million from Saudi Arabia.

Moreover, remittances from other Gulf Cooperation Council (GCC) countries increased 8.5% to $286.4 million and a 40.9% increase was recorded in inflows from European countries, which clocked in at $262.5 million in the month under review compared to the same month last year.