Foreign debt, liabilities peak to Rs51.72 trillion in Oct-Dec

Debt and liabilities stood at Rs50.484 trillion in the first quarter of the ongoing fiscal year 2021-22, SBP data shows

February 25, 2022

- Debt, liabilities stood at Rs50.484 trillion in the period ended on September 2021.

- Total debt increased 14.6% to Rs42.937 trillion at end of December 2021.

- Domestic debt rose to Rs26.746 trillion as of December 2021 from Rs24.314tr.

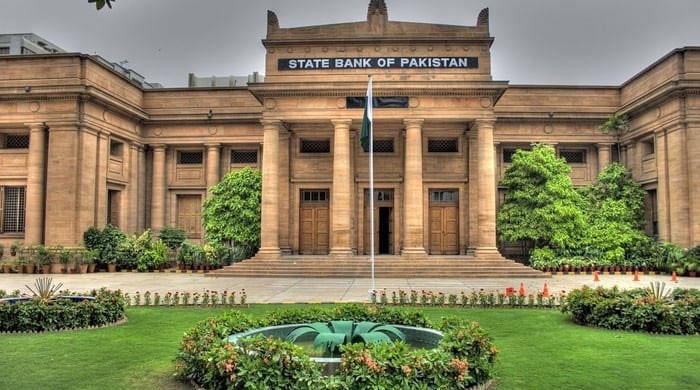

Country’s total debt and liabilities surged 15.5% to a record high of Rs51.72 trillion during the second quarter of the ongoing fiscal year 2021-22 (October-December) from Rs45.20 trillion in the same period of last year, the State Bank of Pakistan (SBP) data showed on Thursday.

The debt and liabilities stood at Rs50.484 trillion in the period ended September 2021.

The State Bank of Pakistan’s (SBP) data showed the country’s total debt increased 14.6% to Rs42.937 trillion at the end of December 2021. Liabilities increased 33.1% to Rs2.944 trillion.

The government domestic debt rose to Rs26.746 trillion as of December 2021 from Rs24.314 trillion a year ago.

External debt stood at Rs21 trillion in December 2021, compared with Rs17.212 trillion in the same period of the previous year.

“Pakistan's debt levels are projected to see their downward path with narrower twin deficits on the back of the planned fiscal adjustment and robust growth,” said The International Monetary Fund (IMF), in its staff report.

“Public debt is projected to fall toward 70% and total external debt to decline toward 35% of GDP by FY2026,” it added.

There are some factors that could affect policy decisions and undermine the programme’s fiscal adjustment strategy, jeopardising debt sustainability, according to the Fund.

Public debt remains sustainable with strong policies under the baseline but also points to risks from policy slippages and contingent liabilities.

Further delays on structural reforms, especially those related to governance and the authorities’ Anti-Money Laundering/Combating the Financing of Terrorism (AML/CFT) action plan with the Financial Action Task Force (FATF), could hamper external financing and investment and thus limit the economic recovery.

Fourth, geopolitical tensions (especially related to Afghanistan) could cause disorderly migration, worsening security conditions, and generate higher volatility in basic food prices (if supply is disrupted) and the exchange rate.

Originally published in The News