Pakistan explores The Roosevelt Hotel joint venture for sustained returns

Alternatively, the govt is also looking at the option of selling PIA-owned hotel entirely, says defence minister

May 12, 2025

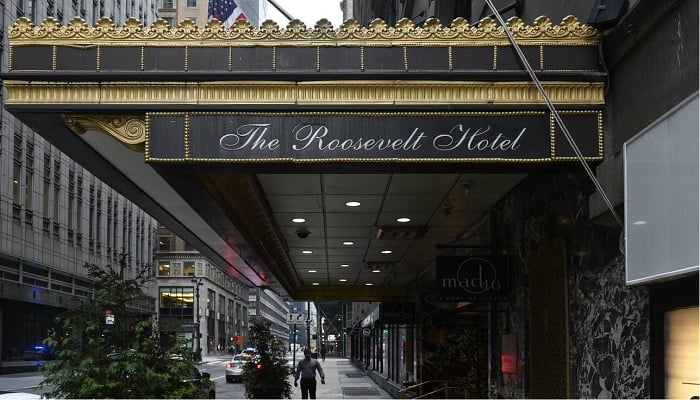

The government is aiming for a joint venture on the Pakistan International Airlines-owned iconic The Roosevelt Hotel building in Manhattan, New York, to secure long-term financial benefits, Defence Minister Khawaja Asif said on Monday.

“While selling the 19-storey property may offer short-term gains or help repay some debt, a joint venture would preserve the asset and generate sustained value,” he argued during the question hour at the National Assembly.

Asif highlighted that the hotel’s prime location, with two entrances and central positioning, made it a unique piece of real estate, which was unmatched in New York.

“Alternatively, the government is also looking at the option of selling The Roosevelt Hotel entirely,” Asif said.

In April, the Privatisation Commission Board in its 233rd meeting discussed various transaction structure options developed by the financial adviser, a consortium led by Jones Lang La Salle Americas Inc (JLL) for the privatisation of The Roosevelt Hotel.

The board also finalised its recommendations for the transaction structure for presentation to the Cabinet Committee on Privatisation (CCOP).

The options include selling the building as it is or opting for a joint venture with a top-tier developer, which has the potential to generate proceeds five times higher, according to a statement after the meeting.

The federal government last month officially invited expressions of interest (EOIs) from potential investors for the privatisation of the loss-making PIA, marking a major development in its bid to offload a controlling stake in the national flag carrier.

According to the Privatisation Commission, the decision has been made to sell between 51% and 100% of PIA shares, along with management control, to the prospective buyer. Interested parties have until June 3, 2025, to submit their EOIs.

The national carrier last month reported that it has posted an annual profit for the first time in more than two decades, ahead of a second attempt by the government to sell the airline.

Islamabad's attempt to privatise PIA last year fell flat when it received only a single offer, well below the asking price of more than $300 million.

Pakistan had offloaded nearly 80% of the airline's legacy debt and shifted it to government books ahead of the privatisation attempt.

The rest of the debt was also cleaned out of the airline's accounts after the failed sale attempt to make it more attractive to potential buyers, according to the country's privatisation ministry.