PSX soars over 9% in highest single-day rise in 26 years, driven by IMF deal, ceasefire

10,000-point gain comes as surging sentiment drives massive buying, both directly and via mutual funds

May 12, 2025

- Benchmark KSE-100 index surges to 117,297.73 points.

- Analysts say halt in trade only intensified bullish momentum.

- PSX remains world's 3rd best-performing market in 12 months.

Stocks recorded their sharpest single-day gain in 26 years on Monday, soaring over 9%, as investors snapped up lucrative deals in one of the fiercest buying frenzies, fuelled by the assurance of International Monetary Fund (IMF) inflows and a US-brokered Pakistan-India ceasefire.

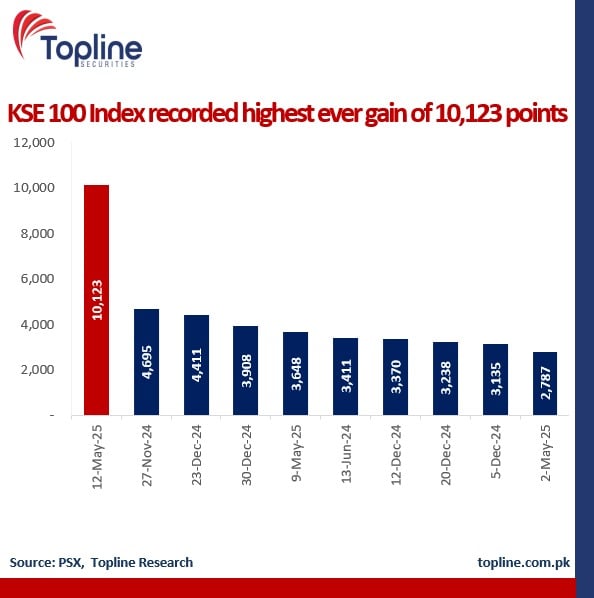

The benchmark KSE-100 index surged by a staggering 10,123 points or 9.45%, to close at 117,297.73, before hitting an intraday high of 117,327.78, while the day's lowest moment saw the index touch 115,794.37.

Over 345 million shares changed hands, reflecting renewed investor confidence and aggressive buying, valued at Rs21.98 billion.

Topline Securities, a brokerage, in a post-market note, said the market witnessed a historic day with the benchmark index rising by 9.45% in a single day, the highest rise after 26 years.

" The massive rally, spurred by easing geopolitical tensions and a major confidence boost from an expected IMF loan tranche, sent the bulls on a stampede," it added.

Trading was briefly halted at the start of the session after the KSE-30 Index surged over 5% within the first five minutes, triggering a market-wide circuit breaker and resulting in a one-hour pause, according to the report.

"The halt only intensified bullish momentum," Topline said, as investors poured into equities following the resumption of trade.

Major contributions to the index's rise came from Fauji Fertilizer Company Limited (FFC), United Bank Limited (UBL), Engro Corporation Limited (ENGRO), Mari Petroleum Company Limited (MARI), and Lucky Cement Limited (LUCK) — collectively adding 3,003 points to the KSE-100 Index.

"According to our channel checks, local individual investors who had been net sellers in the recent past were aggressive buyers during the session directly and through local mutual funds," the brokerage said.

As per Bloomberg, the KSE-100 index is the world's third-best-performing capital market in the last 12 months.

Brokerage Arif Habib Limited noted that the most significant catalyst is the ceasefire agreement between India and Pakistan — a major diplomatic achievement that sharply lowers geopolitical risk in the region.

The announcement comes after weeks of tension following the Pahalgam attack, which had triggered aggressive selloffs and fuelled widespread investor concerns.

Adding further momentum is US President Donald Trump's recent statement pledging support for resolving the Kashmir issue and encouraging enhanced trade relations between India and Pakistan.

"To highlight, Pakistan’s exports to the US reached $4 billion in FY25TD, compared to imports of $1.5 billion, delivering a sizable trade surplus of $2.5 billion," the brokerage said.

Amid easing regional tensions, Pakistan has secured a crucial financial lifeline with the IMF’s approval of a $1 billion disbursement under the Extended Fund Facility (EFF) and a $1.4 billion Resilience and Sustainability Facility (RSF).

The IMF’s dual approval not only ensures immediate external financing support but also signals international endorsement of Pakistan’s reform agenda, further strengthening investor confidence amid improving macroeconomic stability.

These developments coincide with the State Bank of Pakistan's recent decision to cut the policy rate by 100bps to 11% — a move that reflects easing inflationary pressure and is expected to boost equity valuations, particularly in leveraged and cyclical sectors.

Together, the ceasefire, IMF support, monetary easing, and the positive shift in trade relations with the US form a powerful trifecta of bullish triggers just as the market attempts to recover from its recent sharp correction that began on April 22, following the Pahalgam attack and subsequent regional tensions.

Since April 22, the KSE-100 index had declined by 12.6% on May 8, with panic-driven selloffs culminating in the largest ever intraday point drop in market history last week, although a sharp 3.5% rebound on May 9 hinted at a sentiment shift already underway.