KSE-100 closes fiscal year 2021-22 on positive note

KSE-100 index stayed mostly in green as investors opted for value hunting due to clarity in finance bill

June 30, 2022

- Market stayed mostly in green as investors opted for value hunting due to clarity in finance bill.

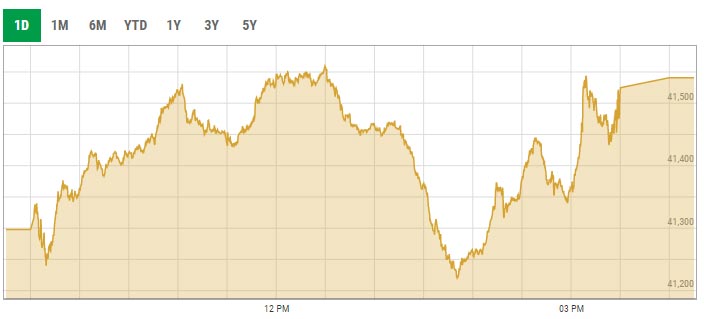

- KSE-100 index closes at 41,540.83 points with a gain 0.59%.

- Continuous recovery of Pakistani rupee against US dollar boosts investor confidence.

KARACHI: The last trading session of the fiscal year 2021-22 saw the benchmark KSE-100 index of the Pakistan Stock Exchange (PSX) close just above the 41,500 level amidst volatility as the bourse managed to churn in decent volumes in the past week. Investors preferred to stay on the sidelines before they take fresh positions in the new fiscal year.

Continuous recovery of Pakistani rupee against the US dollar in the inter-bank market coupled with the approval of the federal budget for 2022-23 boosted investor confidence.

At close, the benchmark KSE-100 index closed at 41,540.83 points with a gain of 243.1 points or 0.59%.

A report from Arif Habib Limited noted that PSX witnessed a positive session today as the Pakistani rupee continued to extend gains against US dollar and cut-off yields on three-month and six-month T-bills fell by two basis points and 15 basis points respectively compared to the previous auction.

"The benchmark KSE-100 index stayed mostly in the green as investors opted for value hunting due to clarity in the finance bill amendments approved by the National Assembly," it stated.

Volumes continued to remain dull, on the contrary, third-tier stocks remained in the limelight.

Sectors contributing to the performance included banks (+111.5 points), exploration and production (+58.8 points), power (+26.9 points), technology (+24.9 points) and cement (+23.2 points).

Shares of 337 companies were traded during the session. At the close of trading, 168 scrips closed in the green, 140 in the red, and 29 remained unchanged.

Overall trading volumes rose to 192.89 million shares compared with Wednesday’s tally of 142.19 million. The value of shares traded during the day was Rs6.78 billion.

K-Electric Limited was the volume leader with 17.49 million shares traded, losing Rs0.05 to close at Rs3.04. It was followed by Agritech with 13.78 million shares traded, gaining Re1 to close at Rs6.55 and Fauji Cement Company with 13.1 million shares traded, losing Rs0.26 to close at Rs14.17.

'FY22 — tough year'

On a month-on-month basis, KSE-100 declined by 3.6% on account of the imposition of a 10% super tax on 13 large-scale industries in the federal budget for FY23 as investors feared further pressure on listed companies' bottom line in this high inflationary environment.

Topline Securities listed two major developments during the last month of the fiscal year:

- FATF has acknowledged that Pakistan had fully complied with the 2018 and 2021 actions plus on anti-money laundering and combating terror financing

- Pakistan received a Memorandum of Economic and Financial Policies (MEFP) for the combined 7th and 8th reviews of the IMF programme

Meanwhile, Ismail Securities noted that the fiscal year 2021-22 was a “tough year” for the stock market as the bourse lost 5,815 points, or 12.3%, during the year. The bourse opened the fiscal year 2021-22 at 47,356 points and closed it at 41,541 points.