Pakistan stocks rebound on value-hunting

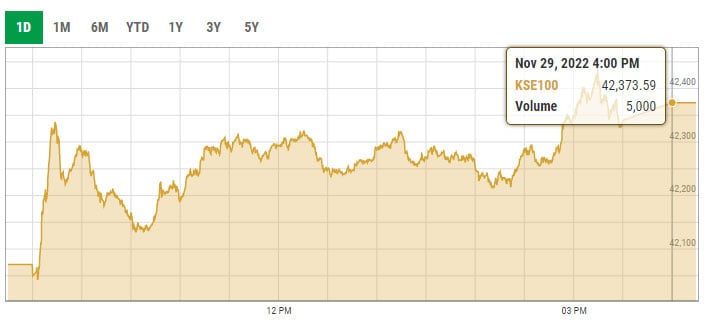

PSX's benchmark KSE-100 index gains 302 points or 0.72% to close at 42,374 points

November 29, 2022

- Valuations become attractive after Monday's selloff.

- Investors hunt bargains to replenish their portfolios.

- Analysts recommend buy-on-dips in the days to come.

KARACHI: Stocks Tuesday pulled off an impressive recovery from Monday’s lows powered by value-hunting as fresh inflows also gave investors a buying signal amid subsiding political noise.

Pakistan Stocks Exchange’s benchmark KSE-100 index gained 302 points or 0.72% to close at 42,374 points after scaling an intraday peak of 366 points.

Arif Habib Limited, a brokerage house, in a post-trade note said stocks bucked Monday’s bearish trend powered by attractive valuations that are up for grabs after a big correction on Monday.

"Investors’ sentiments improved after Pakistan received $500 million from the Asian Infrastructure Investment Bank (AIIB)," the brokerage said.

It added that participation remained active throughout the day, with third-tier stocks witnessing the most activity.

The State Bank of Pakistan Tuesday received $500 million from the AIIB, confirmed Finance Minister Ishaq Dar in a Twitter announcement.

"AIIB has transferred today, as per their Board’s approval, to State Bank of Pakistan/Government of Pakistan US $ 500 million as program financing," Dar tweeted.

Major positive contributors in the trading session were System Limited, Hub Power Company Limited, Lucky Cement, Habib Bank Limited, and PSO, which cumulatively added 181 points to the index.

Traded volume and value for the day stood at 139 million shares, down 43%, and Rs5.1 billion, down 27% respectively. WorldCall Telecom Limited was the volume leader with 18.58 million shares.

Sectors contributing to the performance were commercial banks (+67.7 points), technology and communication (+60.7 points), power generation and distribution (+57.5 points), exploration and production (+34.2 points), and cement (+28.5 points).

Volumes shrank from 244.4 million shares to 139.2 million shares, down 43.0%. The average traded value also decreased by 27.5% to $22.6 million as against $31.1 million.

Stocks that contributed significantly to the volumes were WorldCall Telecom Limited, Unity Foods, Karachi Electric, Bank Alfalah Limited, Dewan Farooque Motors Limited, Ghani Chemical Industries Limited, and Hub Power Company.

“Going forward, we recommend investors to adopt a buy-on-dips strategy in the banking and technology sectors,” JS Global said in a note.