Gold price in Pakistan ticks up in lukewarm demand

Gold rate (24 carats) moves up by Rs300 per tola to settle at Rs194,400 per tola

February 28, 2023

- Gold rate moves up by Rs300 per tola to settle at Rs194,400.

- SBP to tighten monetary policy to rein the runaway inflation.

- International bullion markets hit a two-month low.

Gold prices in Pakistan ticked up on Tuesday amid lukewarm demand as investors were anticipating the central bank’s hawks to tighten the monetary policy to rein in the runaway inflation.

The international bullion markets hit a two-month low and were on track for their biggest monthly decline since June 2021, pressured by an elevated dollar and prospects of more rate hikes from the US Federal Reserve.

According to All-Pakistan Sarafa Gems and Jewellers Association (APSGJA), the price of gold (24 carats) ticked up by Rs300 per tola and Rs257 per 10 grams to settle at Rs194,400 and Rs166,666, respectively.

Analysts say gold may be an effective way to defend investments against inflation, but only over long periods of time.

Comparatively, over shorter periods of time, the inflation-adjusted price of gold swings wildly, making it not a very strong near-term hedge for inflation.

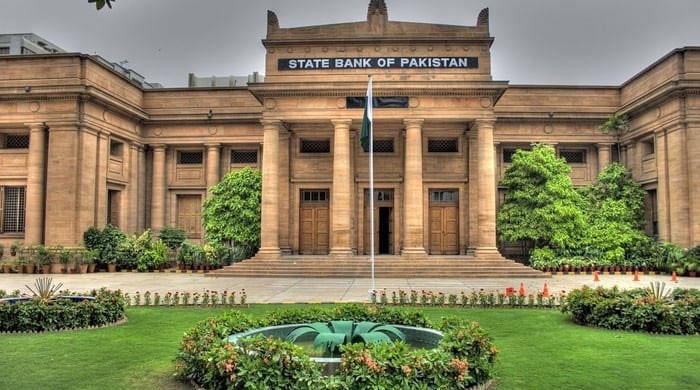

Consensus prevails in the markets that the State Bank of Pakistan (SBP) will jack up borrowing costs substantially.

The SBP's Monetary Policy Committee (MPC) is expected to raise interest rates by at least 200 basis points as early as next week in an off-cycle review as the cash-strapped government struggles to secure a bailout from the International Monetary Fund (IMF) to boost its beleaguered economy.

The central bank "preponed" its MPC meeting on March 2 — which was initially scheduled for March 16.

During a period of high inflation, as is currently the case in Pakistan, investors could go back to buying gold as a real physical asset that holds its value.

Periods of high inflation often coincide with a hike in interest rates and general economic uncertainty. As a result, gold is considered a safe haven and, it is believed, the higher the demand the greater the price.

Spot gold was down 0.5% at $1,808.07 by 1334 GMT, having earlier hit its lowest since late December at $1,804.20.

Prices touched their highest since April 2022 in early February but soon reversed course. Bullion has fallen more than 6% so far this month after strong economic data boosted expectations of more rate hikes by the U.S. central bank.

Gold is having a negative month as the market is expecting interest rates to remain higher for longer, said Carlo Alberto De Casa, an external analyst at Kinesis Money.

“If inflation continues to rise, then gold might fall to the $1,730-$1,740 range.”

Fed Governor Philip Jefferson said on Monday that he was under “no illusion” that inflation would return quickly to the U.S. central bank’s target.

Gold is moving closer to a very interesting area of support between $1,780 and $1,800, but economic data may determine how firm a support zone it will be, Craig Erlam, senior market analyst at OANDA, said in a note.

— Additional input from Reuters