Petroleum price hike to follow rupee depreciation, warns Musadik Malik

Musadik Malik blames ongoing political instability for sudden massive depreciation of rupee versus dollar

March 03, 2023

State Minister for Petroleum Dr Musadik Malik has warned of an increase in the price of petroleum products after a massive depreciation of the rupee against the dollar.

While talking during Geo News programme “Capital Talk” on Thursday, Dr Malik said that the rupee’s depreciation may lead to an increase in the price of petroleum products in the coming days. He also shared that Pakistan’s talks with Russia on importing oil were progressing.

“The sudden increase in the price of the US dollar had happened due to [political] instability,” said the minister, adding that it was difficult to run the country in such an “uncertain time”.

It is pertinent to note that in the last fortnight's review, Finance Minister Ishaq Dar had announced a cut in the prices of petroleum products.

The government slashed the price of petrol, taking it to Rs267 per litre after a decrease of Rs5 per litre while the price of diesel was maintained at Rs280 per litre.

Dar added that after a reduction of Rs12 per litre, light diesel oil's price has been moved down to Rs184.68 per litre and after a Rs15 per litre reduction in the rate of kerosene oil, its price has now been fixed at 187.73.

Rupee plunges to historic low

The state minister warned of an increase in the price of petroleum products after the rupee plunged by nearly Rs19 against the US dollar on Thursday ahead of the central bank's monetary policy review and amid concerns over a stalled International Monetary Fund (IMF) deal.

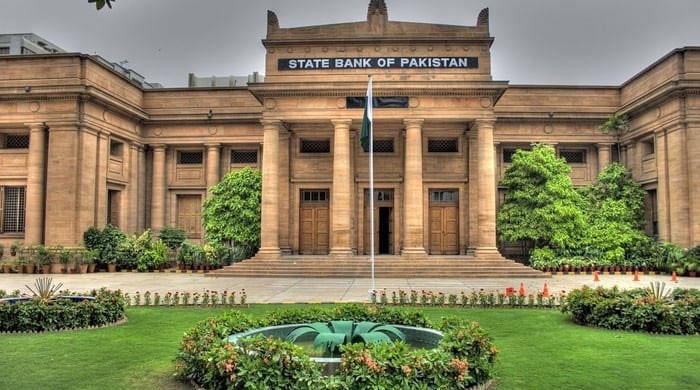

The rupee slumped by Rs18.98 or 6.66% to close at 285.09 against the dollar in the interbank market as per the State Bank of Pakistan (SBP), down from Wednesday’s close of Rs266.11.

Speaking to Geo.tv, ECAP general secretary Zafar Paracha said the main concern in the market was the delay in the agreement with IMF, however, the lender's condition to peg the currency rate with that of the grey market — also referred to as the Peshawar market — had triggered uncertainty.

Paracha said, in his view, the current rate was too high and shouldn't have risen that much.

He added that in the grey market, the greenback was trading at Rs290 a day ago.