Apple profit slips, but gains in services

SAN FRANCISCO: Apple's quarterly profit slumped on a widely expected drop in iPhone sales, but gains in services offered some optimism on its move to ease dependence on its...

October 26, 2016

SAN FRANCISCO: Apple's quarterly profit slumped on a widely expected drop in iPhone sales, but gains in services offered some optimism on its move to ease dependence on its smartphone.

The company said Tuesday that profit fell 19 percent to $9 billion in the fiscal quarter ending September 24. Revenue fell nine percent to $46.9 billion from $51.5 billion a year earlier.

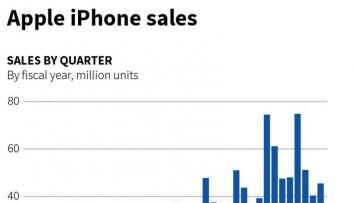

The results were largely in line with market forecasts and showed sales of the iPhone -- Apple's biggest revenue and profit driver -- down five percent from a year ago to 45.5 million units.

The quarterly update only provided limited information on the reception of the newest iPhone models, the iPhone 7 and 7 Plus, which were released in early September.

Analysts were expecting declines in iPhone sales with many smartphone markets saturated, a situation that has led Apple to focus on new products like the Apple Watch and services like mobile payments and streaming music.

Chief executive Tim Cook welcomed what he called "our strong September quarter results," saying they "cap a very successful fiscal 2016 for Apple."

"We're thrilled with the customer response to iPhone 7, iPhone 7 Plus and Apple Watch Series 2, as well as the incredible momentum of our Services business, where revenue grew 24 percent to set another all-time record," he said in a statement.

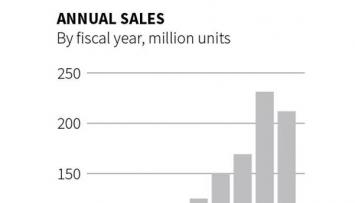

Apple closed out its fiscal year ending September 24 with a net profit of $45.7 billion on revenues of $215.6 billion, both figures lower than the prior year.

More than a device maker

Frank Gillett, a Forrester Research analyst, said the results show Apple is making progress in diversifying its mix of products and services as smartphone sales stagnate.

"The rise of services shows they're more than a devicemaker," Gillett said.

"It's indicative of the depth of engagement of their customers." The more consumers use Apple applications and services, "the less likely they will switch to a rival," GIllett said.

Apple's results showed a six percent drop in iPad unit sales and a 14 percent decline in the number of Mac computers sold.

While iPhone sales accounted for more than half of revenues, services revenue grew to $6.3 billion as the company expanded services such as Apple Pay and its enterprise offerings.

In the key "Greater China" market, Apple said revenues were down 30 percent from a year to $8.8 billion. But the company noted a 10 percent rise in revenue from Japan and cited gains in other global markets.

Patrick Moorhead of Moor Insights & Strategy said Apple "met most expectations but didn't have a great quarter" with sales of its main products lower.

"I'm suspecting there may have been availability issues on the iPhone 7 and Watch," Moorhead said.

Still, Apple "had a banner quarter in services" which is a positive sign, according to the analyst.

"It's important the investment community take a long view versus looking at short-term growth estimates as a knee jerk Apple response would only work against the company and the stock price," Moorhead said.