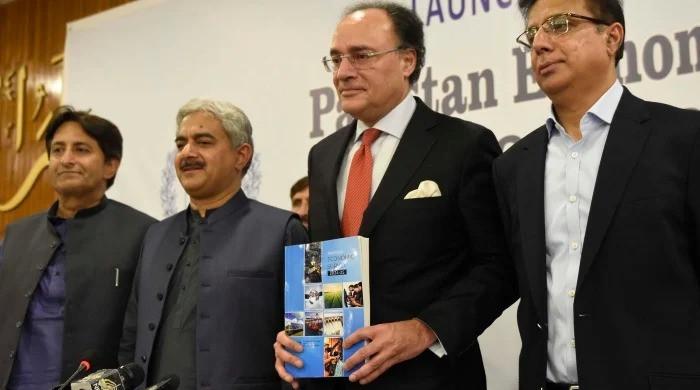

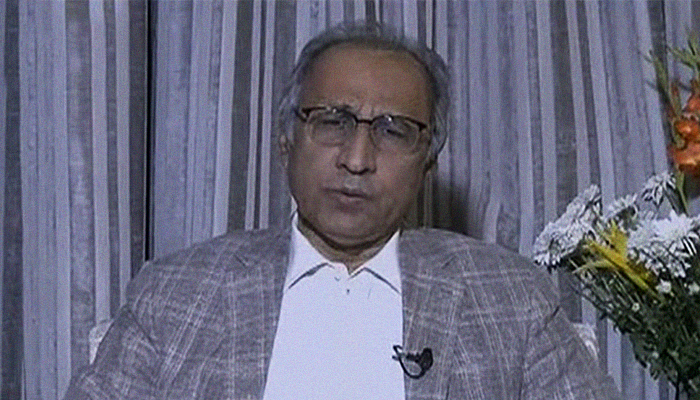

'Ambitious' budget to be adjusted if coronavirus crisis continues: Hafeez Shaikh

'Tax collection is not our priority at the moment; rather, it is to provide relief to the people,' Shaikh said in the programme on Budget 2020-21

June 12, 2020

KARACHI/ISLAMABAD: Adviser to the Prime Minister on Finance Dr Abdul Hafeez Shaikh said late Friday the "ambitious" Budget 2020-21 would have to be adjusted if the coronavirus crisis continued.

Responding to Geo News talk show host Shahzeb Khanzada's question of how it was possible to achieve a 27% increase in revenue, given the gross domestic product (GDP) rate being 2.1% and an inflation of 6.5%, Shaikh said he agreed with the anchorperson because it "does seem ambitious at the moment".

"You're right, it seems ambitious right now. There's so much uncertainty about the future so we cannot say much. If corona [virus crisis] continues and its severity increases and the lockdown in some way or the other goes on, then this will need to be adjusted," the adviser noted.

"However, if, in a good scenario, there's improvement over the next two or three months and our economic activity kickstarts, then I think it's attainable," he added.

Shaikh emphasised that Pakistan's need of the hour was collecting taxes in a good manner. "We do not intend to be heavy-handed because tax collection at the moment is not our priority. Rather, our priority is to provide relief to the people and that's why no new tax was imposed in this budget.

"In fact, many of the taxes — their number and rates — have been reduced," he explained.

When asked if the GDP and tax targets were based on the condition of economic activity kickstarting or if they were the worst-case scenario, the finance adviser said it was correct that they were dependent on restarting of business activities.

"If our economy picks up after three months, then there can be improvement," he said, adding that the 2.1% growth rate of GDP was already calculated with a smaller base, which had fallen considerably due to the negative growth.

"So, given how ours is such a big economy, any movement in the agriculture and manufacturing [sectors] or if the lockdown's effects start shedding, there will be improvement.

"Another factor that cannot be fully forecast is by how much will the demand for our exports grow," Shaikh said.

"If European countries, China, and other nations with which we have deep connections, if their economies also start to do well, then our exports may bolster. Even in these conditions, exports in the month of May, in fact, rose."

Noting that he had highlighted the issue in a previous programme as well, Khanzada asked the adviser if the government was working against its own goal of boosting investment by creating higher crowding-out effect through borrowing if the tax revenue target of Rs917 billion — three times from last year's and that, too, in a best-case scenario — was not met.

"If economic activity starts, given the low interest rate, then it can create a conducive space for investment," the anchorperson said. "It's great that you're not borrowing from the State Bank of Pakistan (SBP) because that would be inflationary.

"However, the more you borrow from commercial banks, the more crowding-out effect would increase as commercial banks lend all [of their funds] to the government and nothing is left for the private sector. Wouldn't that be creating more crowding-out effect?

"Wouldn't that be the government working against investment? Wouldn't the commercial banks then not have money to lend to the private sector?"

To which, Shaikh said it sounded right but the Prime Minister Imran Khan-led government was trying not to borrow a lot and to lower its expenditures.

"And to do that [borrow less], whatever we can do — such as reducing our expenditures — we're already doing. However, there are some things that are not in our control.

"We have to repay Rs2.9 trillion of loans that the prev government had obtained. We can't rid ourselves of that. This is a national requirement for which we are forced to borrow.

"As for our own incomes and our own expenses, looking aside from the past interest payments, those are manageable and the primary balance was, in fact, positive," the adviser stated.

In response to a question on higher petroleum development levy (PDL) and whether the country should expect petroleum prices to rise, Shaikh said the levy was "a natural instrument in a situation when oil prices fall".

"Now that the prices have fallen, revenue through the PDL has risen a little bit. It's very challenging to forecast about international markets and oil prices," he said, adding that the government would stick to its goal of transferring the gains to the people.

Khanzada then mentioned how Pakistan has had a historical issue of the 'low-interest-low-inflation' scenario not continuing for longer periods.

"Now that you've increased the PDL collection amount, if petrol prices rise — and you're not borrowing from the SBP but the money supply is definitely growing... it has reached 14% — the currency has already dipped, depreciation will cause another inflationary impact, and when the economy reopens and demand rises, that, too, may create an inflationary impact, does it mean that inflation in Pakistan will rise again, leading to higher inflation rate, instead of longer period of lower policy rate to benefit the private sector?"

Shaikh responded by saying the government had similar concerns.

"If oil prices do not fall further and are going upwards, then we will lower the PDL so that the entire burden in the coming days does not fall on to the public," he said.

In response to another question over how the development budget was 18% lower than last year and if that mean reduced number of projects, the adviser explained that only some Rs500 billion of the Rs701 billion allocated to the Public Sector Development Programme (PSDP) last year was spent.

"Therefore, we have allocated Rs650 billion this year and we will try our best to ensure that the actual expenditure is higher than last year's.

"We have also thought that we should invest in schemes that give quicker payoff — not after years — and that are labour-intensive so that there's more job creation, more immediate creation of employment opportunities.

"The planning ministry has been handed the responsibility to manage the portfolios of projects in such a manner that it becomes an instrument for the public and the job-seekers," Shaikh added.

When asked about the higher sums set aside for the Ehsaas Programme and coronavirus-related expenditures and how — with chances of revenue target not being fulfilled and likely possibility of more money being spent in the aforementioned categories than allocated — it may lead to the fiscal-deficit target not being met, Shaikh explained that nothing could be said about the coronavirus with certainty but "what we can say for sure is that the government's No. 1 priority is to deal with the coronavirus".

"Almost Rs500 billion of the Rs1.2-trillion package was left so that sum will be spent in the coming year," he noted.

"As for the different windows and ways the government can support businesses, there will be addition to those in new manners and ways, with new ways of thinking, to tackle the coronavirus, to administer an injection to the economy.

"We have given a package and concessions to the construction industry. The capital gains tax was reduced significantly in the budget to provide further incentive. A sum of Rs30 billion was set aside for subsidies for the people with lower incomes to construct houses and to provide subsidies in mortgages," the adviser added.

Shaikh said he wished to share a few more things.

"First off, import duties — custom taxes — on some 20,000 items of raw materials for our industries will be made zero and the primary goal of doing that is to reduce the cost of doing business.

"Similarly, many withholding taxes are either being removed or the number of withholding taxes is being reduced. Regulatory duties on a number of products are also being reduced."