Pakistan-born Fahad Shah arrested in US over million-dollar fraud

Shah submitted forged documents under the name of his wedding planning company to obtain loans of over $3 million

June 24, 2020

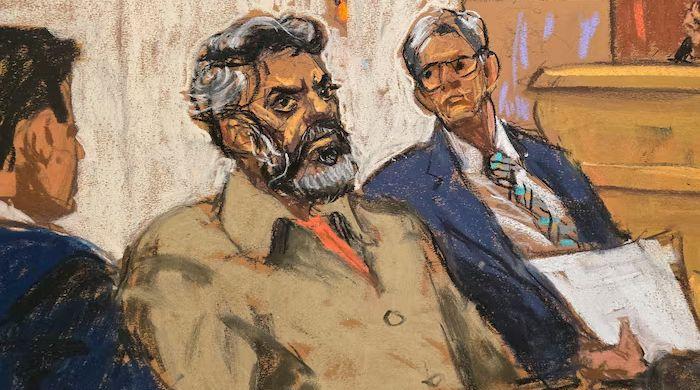

KARACHI/DALLAS: Pakistan-born American Fahad H. Shah has been arrested in Texas by the Federal Bureau of Investigation (FBI) for a million-dollar fraud and deception, US authorities confirmed Wednesday.

Shah was produced Tuesday morning in the court of East Texas Eastern District Magistrate Judge Christine A. Novak. He hails from Hyderabad, Pakistan, and has been doing decoration work for various events, including musical concerts, in the US.

Under the name of his wedding planning company 'WBF Weddings by Farah, Inc.' set up in 2011, he submitted false loan applications and forged documents to procure over $3 million, which he then used for personal expenses, purchases, and mortgage payments.

The amount was obtained under the US Small Business Administration's (SBA) Paycheck Protection Program (PPP), according to the statement of the indictment. The funds were approved as per the Coronavirus Aid, Relief, and Economic Security (CARES) Act, a law under the PPP that came into effect in March 2020.

Interestingly, in 2018, the WBF Weddings by Farah, Inc. had "forfeited its existence due to a failure to file a state franchise tax return and/or to pay state franchise taxes", the statement added.

Shah, according to the charge sheet, used the funds "for personal expenses, including the purchase of a luxury automobile, home mortgage payments, and other items". The vehicle in question was allegedly a $60,000 Tesla car.

In a recorded call, the Pakistani man also lied to "an agent of the government, who posed as a representative of Company 1".

The charge sheet noted that his "scheme caused intended losses of at least $3.3 million, based on the two PPP loan applications submitted to lenders".

In his applications to the two banks, he submitted "false and misleading" information, seeking $1,753,875 and $1,592,657, respectively, and sought another $1,592,657 from a public company dealing in processing credit card payments and small-business lending.

He cited his company as having employed at least 92 and at maximum 126 employees in the three applications. He also mentioned that he had paid "between $1,707,250 and $2,481,100" and "between $1,707,250 and $2,217,000" in wagers, tips, and other compensation in the applications to the two banks.

Shah further wrote in the applications that the average monthly payroll of his company was $637,063 — when, in fact, there was no employee working for him.

In addition, he submitted falsified Employer's Quarterly Federal Tax Returns (IRS Form 941s) for various quarters of 2019 and the first one of 2020.

A press release issued by US Department of State confirmed that Shah was initially given $1,592,657 under the PPP programme.

If convicted by federal authorities, Fahad Shah could face up to 30 years in prison, a fine up to $1 million, and a term of supervised release of up to five years — for four of the eight counts each.

He could also face up to 10 years in prison, a fine up to $250,000, and a term of supervised release of up to three years, if convicted, for the other four counts.

Shah did not return a call by Geo News for a comment. However, his community expressed regret over the news of his arrest.

In a statement, US Attorney of the Eastern District of Texas Stephen J. Cox said Shah was the third person to be booked and indicted for fraudulently obtaining a loan under the programme.

Meanwhile, the US Department of Justice (DOJ) has launched a crackdown on businesses that allegedly misused the programme and submitted fake documents to banks to obtain funds from the government through fraud.

It should be noted that the US government had allocated $700 billion to the SBA's PPP for small businesses affected by the coronavirus pandemic across the country. The money was set aside two months ago but a number of frauds have since surfaced.

US officials stressed that if anyone had any information about a similar fraud, they should contact them and provide more details.