Funder lays claim to Broadsheet’s US$29 million Pakistan award

Isle of Man court prevents Broadsheet liquidator from distributing monies to Broadsheet’s creditors in violation of agreements

April 30, 2021

- Broadsheet LLC faces legal claim from Cayman Island hedge fund

- VR Global has claimed in its US filing that it gave Broadsheet US$6 million in 2017 through a legal contract in exchange for a “priority lien” over the proceeds of the arbitration against Pakistan

- Broadsheet was hired by Pakistan more than two decades ago to trace assets belonging to Nawaz Sharif

LONDON: The Broadsheet LLC is facing a legal claim for almost the full award amount of around $29 million from the Pakistan government, from a Cayman Island hedge fund that provided funds to Broadsheet’s lawyers to finance arbitration proceedings against Pakistan at the London High Court’s Financial Division and a court in the Isle of Man has prevented the Broadsheet liquidator from distributing monies to Broadsheet’s creditors unless a decision is made on the application by the funder, according to court papers reviewed by The News and Geo.

This reporter has seen papers that show that VR Global Partners has filed a case in the Isle of Man and a petition at the US District Court for the District of Columbia against Broadsheet’s the UK and US lawyers at Crowell & Moring seeking attendance in court of the Washington DC-based Crowell partner, Stuart Newberger, to answer issues related to the disbursement of nearly $29 million that Pakistan paid to Broadsheet in awards proceeds.

VR has claimed in its US filing that it gave Broadsheet US$6 million in 2017 through a legal contract in exchange for a “priority lien” over the proceeds of the arbitration against Pakistan. According to VR’s claim, it’s entitled to US$27.8 million – almost the entire award amount that Pakistan paid to Broadsheet.

The hedge fund claims that it has obtained court orders in the Isle of Man “preventing the liquidator of Broadsheet from distributing monies to Broadsheet’s creditors in violation of those agreements”.

The writ at the US District Court seeks full disclosure from Stuart Newberger relating to the proceeds of a claim by Newberger’s client - asset recovery firm Broadsheet LLC - against Pakistan so that the evidence could be used in the Isle of Man court proceedings.

Broadsheet was hired by Pakistan more than two decades ago to trace assets belonging to former prime minister Nawaz Sharif and his family members, as well as several other politicians and businessmen.

Pakistan broke the contract in violation of the agreement it had signed and the case has so far cost the country close to $65 million in legal fees and awards after Kaveh Moussavi, who beneficially owns Broadsheet, brought the case before sole arbitrator Sir Anthony Evans QC under the rules of the Chartered Institute of Arbitrators.

The arbitration judge found that Pakistan had conspired to criminally defraud Broadsheet. The Broadsheet LLC’s lawyers convinced the London High Court to seize Pakistan’s assets at the United Bank Limited (UBL) in December 2020.

The UBL then transferred US$28.7 million to an escrow account controlled by Broadsheet’s court-appointed liquidator Roger Harper in the Isle of Man.

VR Global claims that Broadsheet should have kept the award money into a designated account but it breached a guarantee by not placing the money in the designated account. VR claims that Newberger, on behalf of Crowell & Moring, had signed a “priorities agreement” between Broadsheet and VR Global establishing entitlement to the award proceeds and that

Crowell & Moring undertook a “clear duty” to hold the award proceeds on trust in an account held by the firm to be distributed under the priorities agreement in favour of VR Global.

According to VR Global’s claim, it should have received the return on its US$7 million investment by January 8 but didn’t hear anything from Crowell & Moring for nearly four months and failed to obtain any information.

It says in the court claim: “Broadsheet and Mr Moussavi hereby irrevocably authorize and instruct the attorneys to receive the claims proceeds on Broadsheet [sic] behalf (and agree to assist the Attorneys [C&M] in making the necessary arrangements to facilitate the direct transfer of the claims proceeds to the attorneys).

The attorneys [C&M] will transfer the claims proceeds to a client trust account, referred to as the Claims Proceeds Account (as defined in the Proceeds Investment Agreement) and also referred to as the IOLTA escrow account in the Contingency Agreement. The Attorneys [C&M] will hold the clunderrust to be distributed in accordance with the Priorities Agreement.”

VR Global also claims that Crowell & Moring is no more entitled to gain 25% of Broadsheet’s recoveries because it breached the contract. It has asked the court to help it obtain every document that Crowell & Moring used to communicate and negotiate with Pakistan lawyers.

VR Global in a statement said that the purpose of its US and Isle of Man court claims is to understand why Broadsheet has not paid “monies owing pursuant to the terms of agreements entered into with Broadsheet, Kaveh Moussavi and Crowell & Moring”.

The development comes after The News and Geo reported that Broadsheet had obtained a further freezing order of over US$1.2 million of Pakistani money held in UBL London. This reporter also revealed that the London High Court has also allowed Broadsheet to serve notices to the National Accountability Bureau (NAB) in Pakistan.

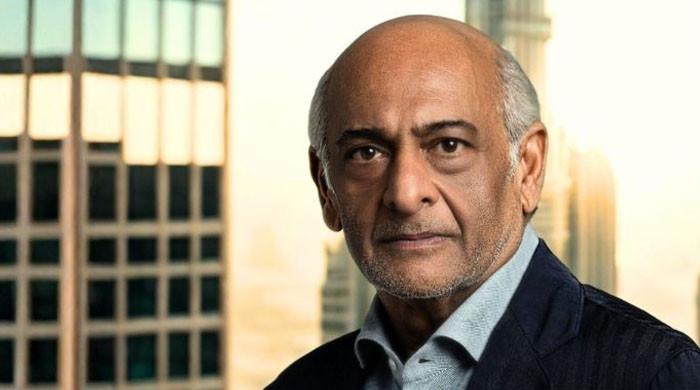

VR Global is part of the VR Capital Group founded by US millionaire investor Richard Deitz. The hedge fund also owns a stake in Process & Industrial Developments (P&ID), a British Virgin Islands entity that is trying to enforce a US$10 billion award against Nigeria.

According to media reports, Nigeria has been trying to obtain US discovery from various VR entities to support its allegations that P&ID’s award was the product of a “fraudulent scheme”.