KSE-100 stocks fall after monetary policy rate hike

Stocks slide over 500 points to settle at 46,008.85 on Tuesday

September 21, 2021

- Benchmark KSE-100 index settles at 46,008.85 points on Tuesday.

- Trading volume increases from 194.7 million shares to 325.9 million shares.

- Shares of 519 listed companies were traded. At the end of the session, 103 stocks closed in the green, and 398 in the red.

KARACHI: The stock market on Tuesday moved towards course correction, shedding 1.12%, as jittery investors went on a selling spree due to a rate spike in the monetary policy meeting.

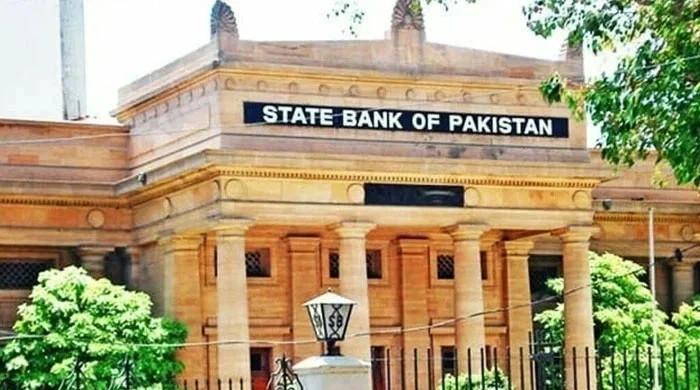

On Monday, the central bank hiked the policy rate by 25 basis points to 7.25% for the next two months.

Trading began on a bullish note, pushing the benchmark KSE-100 index closer to an intra-day high of 46,828.20 in early hours. However, the market recorded only a slight movement from that point onwards.

In the final hour, selling pressure built up and profit-booking by investors eroded all the gains.

A report from Arif Habib Limited (AHL) noted that the market posted an increase of 305 points during the session early on, however, lost that gain and by the end of the session lost a total of 1,055 points (including the erosion of 305pts earned earlier).

“The market on close saw a steep decline,” it said, adding that selling was witnessed across the board, with heavy implication on technology and cement sectors.

The benchmark KSE-100 index fell 519.36 points or 1.12% on Tuesday, to close at 46,008.85 points.

Despite the low leverage level in the market in Deliverable Future Contract (DFC) and Margin Trading System (MTS) and Margin Financing System (MFS) segments, the index melted due to calls of redemption at mutual funds.

The report added that regardless of the steep decline in the index, “overall trading volumes remained low comparative to the hay days seen in outgoing fiscal.”

Volumes increased from 194.7 million shares to 325.9 million shares (+67% day-on-day). The average traded value also increased by 53% to reach $73.1 million as against $47.9 million.

Telecard Limited was the volume leader with 28.1 million shares, gaining Rs0.05 to close at Rs22.06. It was followed by WorldCall Limited with 26.4 million shares, losing Rs0.08 to close at Rs3.11, and TPL Corp with 21.4 million shares, gaining Rs0.65 to close at Rs24.98.

During the session, shares of 519 listed companies were traded. At the end of the session, 103 stocks closed in the green, 398 in the red, and 18 remained unchanged.

Sectors contributing to the performance included cement (-101 points), technology (-81 points), banks (-45 points), fertiliser (-39 points) and exploration and production (-34 points).

Individually, major gainers were Habib Metropolitan Bank (+18 points), MCB (+18 points), Bank AlFalah (+14 points), Azgard Nine (+14 points) and Colgate-Palmolive (+7 points).

Meanwhile, major losers were Systems Limited (-53 points), Meezan Bank (-37 points), HBL (-34 points), Lucky Cement (-32 points) and TRG Pakistan (-23 points).