Pakistani rupee will not 'swing wildly' next week, say analysts

Pakistani rupee concluded the week by closing at Rs169.03 against the US dollar

September 26, 2021

- Pakistani rupee concluded the week by closing at Rs169.03 against the US dollar.

- The rupee is expected to move in the 169-169-50 range over the next week, says foreign exchange expert.

- Govt, SBP issue directives to achieve fiscal and external discipline.

KARACHI: The Pakistani rupee is expected to break the all-time low closing record of 169.12/dollar next week and will trade in range, said foreign exchange experts and analysts Sunday.

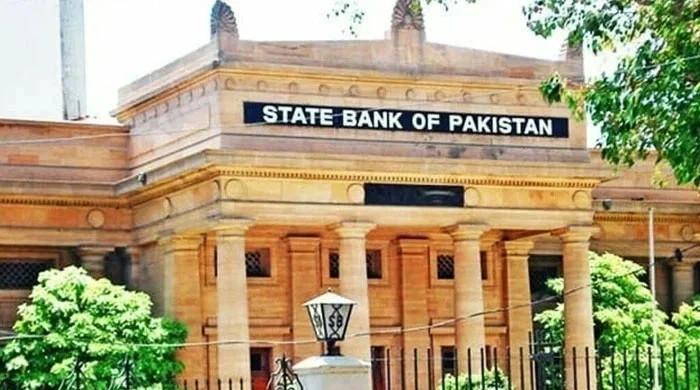

They attributed these developments to measures taken by the State Bank of Pakistan (SBP) adding that they will ensure that a further slide in the exchange rate does not occur.

The local currency traded in narrow ranges during the outgoing week. It ended at 168.72 to the dollar in the interbank market on Monday. It concluded the week by closing at 169.03.

“We have to monitor whether the local unit will be successful to move in tandem with the measures taken to curtail imports and reduce current account deficit. We are watching how the demand side calms down," said a foreign exchange expert.

The rupee is expected to move in the 169-169-50 range over the next week, he added.

SBP's policies for external, fiscal discipline

The government and the SBP have issued several directives to achieve fiscal and external discipline. The SBP used to say “the exchange rate is the first line of defence for the current account deficit then interest rates and other tolls”.

The SBP raised the policy rate by 25 basis points to 7.25%, signaling more rate hikes in coming months. Dr Reza Baqir, governor SBP, in his recent interview aired on CNBC said, the Monetary Policy Committee decided that the time had come to begin tapering. This was due to Pakistan’s stronger-than-expected demand growth and a sense the government had been successful in controlling the delta variant.

However, markets sensed that the move was taken due to rising inflation risks, falling rupee and the weakening current account balance.

The SBP has directed banks to submit information related to their all expected payments (imports) of $500,000 and above for the next five days. The central bank has also strengthened the existing data reporting mechanism to further sharpen its market liquidity projections. This facilitates as well as supports the smooth functioning of a flexible and market-determined exchange rate system.

Besides, the SBP has also tightened conditions for consumer finance.

The government plans to issue Islamic dollar bonds of $1.5 billion, increase in cash margins for luxury imports, more proactive reporting of trade, integrated reporting of tax and returns, verbal intervention on inflation, etc.

The rupee has lost 11% since its peak in May. However, the foreign exchange reserves are near all-time highs and the real effective exchange rate (REER) is at 95.

Analysts said there should be continued support for the rupee at least till the IMF talks near conclusion.

The majority of the moves have already been made and entry into the IMF will unlock funding and the rupee will start to stabilise. The rupee is likely to depreciate by another 3-5 percent till June 2022.

Originally published in The News