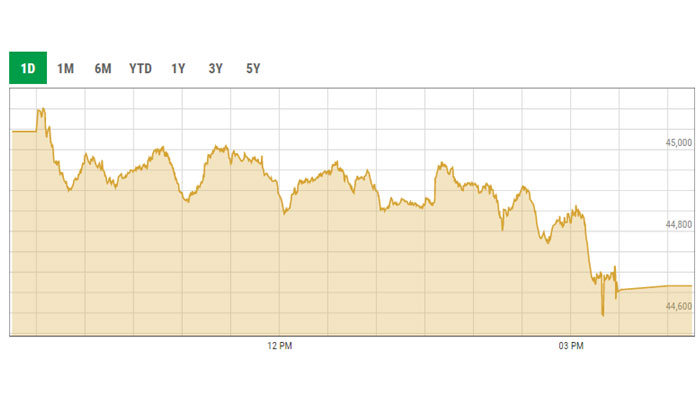

Bourse turns bearish, KSE-100 index falls 378 points

Benchmark KSE-100 index records a decrease of 377.93 points to settle at 44,666.57 points

October 05, 2021

- Benchmark KSE-100 index records a decrease of 377.93 points to settle at 44,666.57 points

- Besides IMF programme worries, continued pressure on rupee-dollar parity caused concern amongst investors, notes AHL report.

- Volumes increased from 267.2 million shares to 334.7 million shares.

KARACHI: The Pakistan Stock Exchange (PSX) succumbed to selling pressure on Tuesday as investor optimism, witnessed a day ago, evaporated and resultantly, the KSE-100 index shed 377 points.

Dismal trade figures — that widened 100% to $11.7 billion in the first quarter of current fiscal year —coupled with a depreciating currency dented investor’s sentiment.

Earlier, trading began on a positive note, however, the investors started booking profits following the announcement of financial results, which wiped off the gains.

Index-heavy cement and technology sectors faced modest selling, which fuelled the downtrend. A lack of positive triggers that could give direction to the market dented investor sentiment, lending to divestment of stockholdings, which erased gains posted during the session at regular intervals.

The benchmark index recorded a decrease of 377.93 points, or 0.84%, to settle at 44,666.57 points.

A report from Arif Habib Limited noted that discussions with the International Monetary Fund (IMF) are still ongoing with the hope of near term resolution and resumption of IMF programme.

“Besides IMF programme worries, continued pressure on rupee-dollar parity has also caused concern amongst investors, especially foreigners who have lately started selling equities,” it said.

Among technology stocks, Octopus hit upper circuit, whereas other tech stocks remained under pressure, especially TRG Pakistan which saw selling pressure despite anticipation of high earnings.

Sectors contributing to the performance included cement (-170 points), technology (-99 points), fertiliser (-45 points), banks (-23 points) and oil and gas marketing companies (-17 points).

Individually, stocks that contributed positively to the index included Mari Petroleum (+74 points), UBL (+19 points), Hubco (+18 points), Pakistan Services (+13 points) and Engro Polymer and Chemicals (+11 points).

Stocks that contributed negatively were Lucky Cement (-66 points), TRG Pakistan (-65 points), Oil and Gas Development Company (-34 points), Systems Limited (-27 points) and Maple Leaf Cement Factory (-24 points).

During the session, shares of 564 listed companies were traded. At the end of the session, 211 stocks closed in the green, 342 in the red, and 11 remained unchanged.

Volumes increased from 267.2 million shares to 334.7 million shares (+25% day-on-day). The average traded value also increased by 34% to reach $79.3 million as against $59.1 million.

Telecard Limited was the volume leader with 30.4 million shares, gaining Rs.76 to close at Rs19.95. It was followed by Azgard Nine with 19.6 million shares, losing Rs1.27 to close at Rs20.12, and Ghani Global Holdings with 39.43 million shares, gaining Rs1.62 to close at Rs39.43.