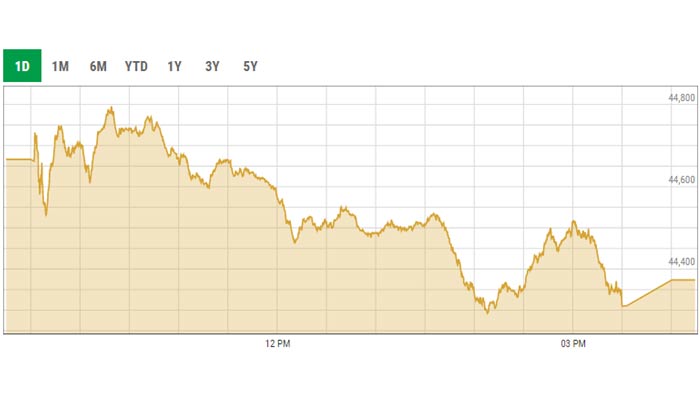

Economic headwinds pull KSE-100 index down

Benchmark KSE-100 sheds 293.34 points to settle at 44,373.23 on Wednesday

October 06, 2021

- Benchmark KSE-100 sheds 293.34 points to settle at 44,373.23 on Wednesday.

- Volumes decline from 334.6 million shares to 252.8 million shares.

- Ripple effects of selling in cyclical as well as oil and gas chains were observed in overall market performance.

KARACHI: The Pakistan Stock Exchange (PSX) continued its descent on Wednesday, shedding nearly 300 points as the market reacted to the repercussions of economic uncertainty.

Investors' sentiment was dented due to a surge in the trade deficit, which widened 100% in July-September 2021 on a year-on-year basis.

Moreover, a drop in cement sales and a depreciating currency took a toll on the investment climate and market participants opted to trade cautiously.

The benchmark KSE-100 index edged down by 293.34 points, or 0.66%, to settle at 44,373.23.

A report from Arif Habib Limited noted that selling pressure continued unabated at the bourse, "courtesy of foreign investors."

“Eye-watering commodity prices, especially coal, have had their bearing on cement and steel sector stocks and had ripple effects on oil and gas marketing companies, exploration and production sectors due to concerns over a potential increase in circular debt emanating from rising energy costs,” it said.

The report highlighted that a major condition from the International Monetary Fund (IMF) for resumption of the $6 billion loan programme is an upward revision in electricity tariff, besides an end to subsidies and increase in tax revenues.

“These measures in part or whole are expected to dent earnings growth of the corporate sector in the coming quarters, which is reflecting on stock prices as well.”

Ripple effects of selling in cyclical as well as oil and gas chains were observed in overall market performance with significant selling pressure in TRG Pakistan among tech sector stocks.

Sectors contributing to the performance included cement (-91 points), textile (-36 points), banks (-35 points), technology (-30 points), fertiliser (-24 points) and exploration and prodcution (+36 points).

During the session, shares of 554 listed companies were traded. At the end of the session, 109 stocks closed in the green, 423 in the red, and 22 remained unchanged.

Individually, major gainers were Mari Petroleum (+43 points), UBL (+22 points), Millat Tractors (+8 points), Colgate-Palmolive (+5 points) and National Foods (+4 points).

While major losers were HBL (-28 points), Cherat Cement (-24 points), Kohinoor Textile Mills (-20 points), Lucky Cement (-19 points) and Engro Corporation (-16 points).

Volumes declined from 334.6 million shares to 252.8 million shares (-25% day-on-day). Average traded value also declined by 26% to reach $59 million as against US$ 79.2 million.

Unity Foods was the volume leader with 25.7 million shares, gaining Rs0.08 to close at Rs31.88. It was followed by Telecard Limited with 20.1 million shares, losing Rs1.35 to close at Rs18.6, and WorldCall Telecom with 16.8 million shares, losing Rs0.14 to close at Rs2.69.